SeQuential Biofuels has opened a solar-powered retail biofuels station in Eugene, Oregon this week. The station offers a full range of ethanol and biodiesel blends: E10, E85, B5, B20 and B100.

SeQuential Biofuels has opened a solar-powered retail biofuels station in Eugene, Oregon this week. The station offers a full range of ethanol and biodiesel blends: E10, E85, B5, B20 and B100.

“We have watched the offering of mainstream organic products and recycled products expand significantly over the last five years”, said Ian Hill, project developer and SeQuential Biofuels co-founder. “Today our customers are demanding domestically-produced, renewable motor fuel options as well.”

The station features a number of green design features including a 244-panel solar array that covers the fueling islands and a "living roof" consisting of 4,800 plants installed in five inches of soil on the roof of the attached convenience store. The 33kW solar array will provide 30% to 50% of the electrical power that the station will require annually.

The “living roof” will help to control rainwater runoff on the site and will help cool the convenience store during the summer. Other eco-friendly design elements include stormwater detention bioswales where plants will filter pollutants from rainwater that rinses the roadways and parking areas and will clean the water before it leaves the site. SeQuential also has made a significant effort to source building materials that are made in the Pacific Northwest region.

The new station also features many energy-efficient design features meant to reduce the station's energy consumption. “Building energy efficient buildings that work with the natural environment adds to SeQuential’s overall goal of sustainability and responsibility,” Hill said. “It just makes sense.”

A portion of the biodiesel dispensed at the station is received from SeQuential-Pacific Biodiesel in Salem, Oregon. SeQuential-Pacific Biodiesel is Oregon’s only ASTM-certified, commercial biodiesel production facility, producing one million gallons of biodiesel per year from used cooking oil collected throughout the Pacific Northwest and from canola oil grown in Eastern Oregon.

The land where the station is located was the site of a previous fuel station that shut down more than ten years ago. Under supervision of the former owner, the site had been contaminated by leaking gasoline tanks and pumps and the owner had abandoned it. SeQuential worked with Lane County and with the Oregon Department of Environmental Quality to clean up the previously polluted brownfield property and put it back into productive use.

“Businesses and individuals are increasingly aware of the impact that their choices have on our economy and on our natural environment,” Hill said. “SeQuential is dedicated to setting an example of responsible, sustainable development and to offering product options that create the most positive impact on people’s lives and communities.”

The fuel station also includes a convenience store that carries top-shelf natural foods and beverages, many of which are produced by regional companies. The store also houses an annex of Sweet Life Patisserie, an established local coffee and pastry shop renowned for its premium coffees, baked goods and savories, complete with wireless internet and an inviting seating area. Local farmers will stock a seasonal fresh produce stand also located at the station.

Founded in August 2002 by Ian Hill and Tomas Endicott, SeQuential Biofuels is a biofuels marketing, distribution and retail company with offices in Portland and Eugene, Oregon. Since its inception, the company has blazed the trail for the biofuels market in Oregon. In partnership with more than 20 regional fuel distributors, SeQuential offers commercial biodiesel/petroleum diesel blends to businesses, governments and individuals at more than 25 retail and cardlock pumps throughout the state.

In 2004, SeQuential formed SeQuential-Pacific Biodiesel, a joint venture with Pacific Biodiesel of Maui, Hawaii, to construct Oregon’s first and only commercial biodiesel production facility. The facility began operation in July 2005, and it produces one million gallons of ASTM-certified biodiesel made from used cooking oil collected from Pacific Northwest restaurants and food processors and from virgin canola oil grown in Eastern Oregon.

This is great! I've been waiting for this station to open for a while now. Now, whenever I'm in Eugene, I'll stop in to fill up with E10 before the trip home. I'd definitely encourage any of my readers in the Eugene area to check out the new SeQuential station. I hope SeQuential finds this station successful and opens up other stations in Oregon - Portland making the most sense for the next retail station.

[A hat tip to Green Car Congress]

Sunday, August 27, 2006

News From My Backyard: SeQuential Biofuels Opens Solar-powered Biofuels Station in Eugene, OR

Monday, August 21, 2006

The Engineer-Poet Tackles Coal-to-Liquids

Well, since I have been too busy these past few weeks to do any good analysis recently, I'll refer you all to an excellent example of what a little bit of simple math can do (ok, more than a little bit, but it's still nothing more complicated than multiplication and division): the Engineer-Poet, over at the Ergosphere recently took aim at Coal-to-Liquids projects, using some back-of-the-envelope math to illustrate how those pushing CTL and citing our vast coal reserves as a solution to our energy insecurity are leading us down the wrong path.

Well, since I have been too busy these past few weeks to do any good analysis recently, I'll refer you all to an excellent example of what a little bit of simple math can do (ok, more than a little bit, but it's still nothing more complicated than multiplication and division): the Engineer-Poet, over at the Ergosphere recently took aim at Coal-to-Liquids projects, using some back-of-the-envelope math to illustrate how those pushing CTL and citing our vast coal reserves as a solution to our energy insecurity are leading us down the wrong path.

Head here for the full story, but as usual, E-P's analysis is pretty dead on:

"If we are looking for good investments in America's future, batteries look like our best bet. The sign for Fischer-Tropsch is pointing down the road to ruin."Now, if only the folks in charge would hire a young staffer for minimum wage to surf through the energy blogosphere for some good ideas. What is it going to take for the politicians, businessmen and policy wonks to realize that electrification of transportation - i.e., plug-in hybrids and electric vehicles - are the way to go. We all remember the incredible potential of plug-ins, don't we... Read more!

U.S. Wind Industry Passes 10,000 MW Milestone

[From Wind Energy Weekly:]

[From Wind Energy Weekly:]

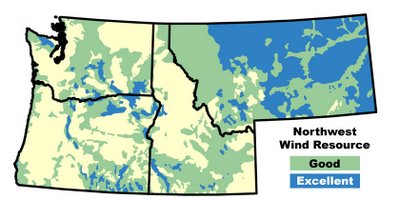

U.S. wind energy installations now exceed 10,000 MW in generating capacity, and produce enough electricity on a typical day to power the equivalent of over 2.5 million homes, AWEA announced August 14. A megawatt of wind power generates enough to serve 250 to 300 average homes.

“Wind energy is providing new electricity supplies that work for our country’s economy, environment, and energy security,” said AWEA Executive Director Randall Swisher. “With its current performance, wind energy is demonstrating that it could rapidly become an important part of the nation’s power portfolio.”

The record growth in wind power is driven by demand for the popular energy source and concerns over fuel price volatility and supply. It was also made possible by a timely renewal of the production tax credit (PTC), a federal incentive extended in the Energy Policy Act signed a year ago by President Bush. Previously, the credit had been allowed to expire three times in seven years, and this uncertainty discouraged investment in wind turbine manufacturing in the country. AWEA is calling for a long-term extension of the PTC before its scheduled expiration at the end of 2007 to avoid further “on-again-off-again” cycles and encourage long-term investment.

The industry is gaining momentum as it grows. The first commercial wind farms were constructed in California in the early 1980s, and after reaching 1,000 MW in 1985, it took more than a decade for wind to reach the 2,000-MW mark, in 1999. Since then, however, installed capacity has grown fivefold (for a chart showing historical cumulative capacity, go to http://www.awea.org/faq/instcap.html ). Today, the industry is installing more wind power in a single year (3,000 MW expected in 2006) than the amount operating in the entire country in 2000 (2,500 MW).

As the U.S. wind energy industry sails past the 10,000-MW mark, AWEA released the following figures and statistics to illustrate some of the economic, environmental, and energy security benefits of wind power development.

Economic benefits:

Environmental benefits:

Energy security benefits:

More figures and statistics on the 10,000-MW milestone are available on the AWEA Web site at www.awea.org/10GW.html.

Wednesday, August 16, 2006

Study Finds Growing Interest in Plug-in Hybrids

A new study by global market research company Synovate shows that 49% of consumers - once the concept of a plug-in hybrid was explained to them - said they would consider purchasing one, roughly the same level of consideration as standard hybrid technology, according to a Green Car Congress (GCC) post.

A new study by global market research company Synovate shows that 49% of consumers - once the concept of a plug-in hybrid was explained to them - said they would consider purchasing one, roughly the same level of consideration as standard hybrid technology, according to a Green Car Congress (GCC) post.

The study, conducted among 1,240 buyers and those intending to buy new light duty cars and trucks, found that while awareness of hybrids is now very high among US consumers, consideration of a conventional hybrid vehicle has flattened at just under 50%.

Tim Englehart, Manager of Alternative Fuels Studies at Synovate Motoresearch had this to say:

Plugging the vehicle in at home means fewer trips to the gas station and lower operating costs. The unknown with this technology is the additional purchase cost. However, there is a considerable group of consumers who are willing to pay to get these unique benefits. It would also be an excellent way to transfer some of the country’s dependence on oil to the national resources we use to power the electric power grid. We believe it’s something to watch.The study also found that while 37% of US consumers would consider purchasing a Flex Fuel vehicle that runs on E85, more than one-third of those same consumers lose interest when they learn that there is a reduction in fuel economy.

Consideration for diesels ran at roughly half the consideration of hybrids.

Our data give us strong reason to believe that if manufacturers can meet the emissions requirements of the new diesel legislation, some are going to surprise the market with the products they introduce and the buyers to whom those vehicles appeal, said Scott Miller, CEO of Synovate Motoresearch.

The information came from Synovate’s latest semi-annual survey of consumer attitudes toward advanced propulsion and alternative fuel vehicles.

There's another summary of the study here, which focuses on the still relatively low awareness of several alternative vehicle/fuel options (most notably, direct-injection diesel).

Well, this is good to see. I hope Toyota and others are paying attention to this.

As regular readers of Watthead know, I have great confidence in the ability of plug-in hybrids to contribute dramatically to a reduction in our petroleum dependence and our overall greenhouse gas emissions. Plug-ins offer:

And, we more or less have the technology for plug-ins available today (unlike some other oft-proposed alternatives).

If as many people are interested in buying plug-ins as are intersted in buying hybrids (and twice as many as are interested in buying diesels), it seems like there is a clear enough market out there to justify bringing at least a few plug-in hybrids to market. And several companies, most notably Toyota, but also Daimler-Chrysler, Honda and even Ford and GM, could probably bring plug-ins to market in just a couple of years. They could easily start by basing their first models on their already established hybrid models. The economies of scale and supply chains are already established for all of the electrical components shared between plug-ins and regular (grid-independent) hybrids, so the only hurdle is to establish supply chains for high-energy batteries suitable for plug-ins.

Consumers want them, governments and fleet operators want them, ... I want them ... why aren't any of the big auto manufacturers offering one yet? Get on with it already!

Read more!

Friday, August 11, 2006

Watthead Turns One Year Old...

... (the website and pseudonym, that is, not the author) ...

... (the website and pseudonym, that is, not the author) ...

That's right, it's now been a whole year since I launched Watthead to discuss climate change, sustainability and the path to a clean energy future.

For those of you who are curious, it all began with this post on August 11th, 2005: Start Fighting Global Warming ... Like Yesterday People!"

The sentiment expressed in that original post still motivates this blog and it's author: we must act quickly and decisively to cut back global emissions of greenhouse gases to mitigate and stabilize the effects of global climate change, many of which are already underway (two links), and one of the most effective ways we can do that, I believe, is to transition our energy infrastructures - both electricity and transportation - to sustainable and clean sources of energy.

I'd like to thank all of you who read this blog, especially those who regularly comment. We're up to about 100 visits per day now, and I appreciate being able to share news and commentary about the exciting and constantly changing field of sustainable energy with all of you.

I'd like to open the comments in this post as an open thread to provide feedback, suggestions, and comments about this blog in general. What would you like to see more/less of? What subjects do you enjoy the most/least? What suggestions do you have to improve the content/layout/anything else of this blog?

Thanks again to all of you out there. I'd love to hear more comments from those of you who don't regularly leave them. Share your ideas, and let's use this blog as a place for discussion, comment and banter.

Cheers,

Jesse Jenkins (aka Watthead)

Thursday, August 10, 2006

More on MIT's LEES Ultracapacitors - Is this the End-Game for Batteries?

[RenewableEnergyAccess (REA) has more today on MIT's high-capacity nanoengineered LEES ultracapacitors, potentially the end-game for battery energy storage. Check it out:]

[RenewableEnergyAccess (REA) has more today on MIT's high-capacity nanoengineered LEES ultracapacitors, potentially the end-game for battery energy storage. Check it out:]

Just about everything that runs on batteries -- flashlights, cell phones, electric cars, missile-guidance systems -- would be improved with a better energy supply. But traditional batteries haven't progressed far beyond the basic design developed by Alessandro Volta in the 19th century. Until now, say researchers at the Massachusetts Institute of Technology.

Work at MIT's Laboratory for Electromagnetic and Electronic Systems (LEES) holds out the promise of the first technologically significant and economically viable alternative to conventional batteries in more than 200 years.

Battery advances, particularly big breakthroughs, are widely seen as complementary to renewable energy technologies, which could benefit from improvements in electricity storage. A major battery breakthrough could also have major implications in the realm of plug-in hybrid electric vehicles whose batteries could be charged partly by renewable energy such as solar or wind.

Joel E. Schindall, the Bernard Gordon Professor of Electrical Engineering and Computer Science (EECS) and associate director of the Laboratory for Electromagnetic and Electronic Systems; John G. Kassakian, EECS professor and director of LEES; and Ph.D. candidate Riccardo Signorelli are using nanotube structures to improve on an energy storage device called an ultracapacitor.

Capacitors store energy as an electrical field, making them more efficient than standard batteries, which get their energy from chemical reactions. Ultracapacitors are capacitor-based storage cells that provide quick, massive bursts of instant energy. They are sometimes used in fuel-cell vehicles to provide an extra burst for accelerating into traffic and climbing hills.

However, ultracapacitors need to be much larger than batteries to hold the same charge.

The LEES invention would increase the storage capacity of existing commercial ultracapacitors by storing electrical fields at the atomic level.

Although ultracapacitors have been around since the 1960s, they are relatively expensive and only recently began being manufactured in sufficient quantities to become cost-competitive. Today you can find ultracapacitors in a range of electronic devices, from computers to cars.

However, despite their inherent advantages -- a 10-year-plus lifetime, indifference to temperature change, high immunity to shock and vibration and high charging and discharging efficiency -- physical constraints on electrode surface area and spacing have limited ultracapacitors to an energy storage capacity around 25 times less than a similarly sized lithium-ion battery.

The LEES ultracapacitor has the capacity to overcome this energy limitation by using vertically aligned, single-wall carbon nanotubes -- one thirty-thousandth the diameter of a human hair and 100,000 times as long as they are wide. How does it work? Storage capacity in an ultracapacitor is proportional to the surface area of the electrodes. Today's ultracapacitors use electrodes made of activated carbon, which is extremely porous and therefore has a very large surface area. However, the pores in the carbon are irregular in size and shape, which reduces efficiency. The vertically aligned nanotubes in the LEES ultracapacitor have a regular shape, and a size that is only several atomic diameters in width. The result is a significantly more effective surface area, which equates to significantly increased storage capacity.

The new nanotube-enhanced ultracapacitors could be made in any of the sizes currently available and be produced using conventional technology.

"This configuration has the potential to maintain and even improve the high performance characteristics of ultracapacitors while providing energy storage densities comparable to batteries," Schindall said. "Nanotube-enhanced ultracapacitors would combine the long life and high power characteristics of a commercial ultracapacitor with the higher energy storage density normally available only from a chemical battery."

This work was presented at the 15th International Seminar on Double Layer Capacitors and Hybrid Energy Storage Devices in Deerfield Beach, Fla., in December 2005. The work has been funded in part by the MIT/Industry Consortium on Advanced Automotive Electrical/Electronic Components and Systems and in part by a grant from the Ford-MIT Alliance.

Resources:

As I hinted at in the into, I think that carbon-based, high-energy density, long lasting ultracapacitors like MIT's LEES ultracap may be the endgame for battery energy storage, at least for electric and plug-in hybrid vehicles.

Ultracaps have very high power densities, delivering great acceleration and performance, as well as taking full advantage of regenerative braking (NiMH and Li-ion batteries typically can't charge fast enough to accept all the energy potentially recoverable during regenerative braking). Additionally, ultracaps are very long-lasting (compared to batteries), can undergo several hundred cycles, last 10+ years, and have typically have no problems with cold-start conditions. Their general weakness is their lack of energy density, meaning they generally have to be coupled with a storage battery (or fuel cell) in any electric drive system.

If MIT or someone else can develop an ultracap with the energy storage of a traditional Li-ion battery, that would be a major coup for the electric vehicle industry. And if the resulting ultracap was largely made of carbon - a material available in practically limitless supply - any potential materials supply limitation concerns (i.e. for lithium or platinum or other battery or fuel cell components) would be essentially a thing of the past.

Let's hope MIT's researchers can deliver this ultracap (and soon) to a commerical partner for deployment in EVs or PHEVs.

[EDIT: Upon closer examination, it appears that this REA article is the same as the one that appeared back in February (and was picked up by Green Car Congress, the Energy Blog and numerous others). It appears that REA's RSS aggregator or whatever else they are using to find posts screwed up (this happens sometimes; yesterday, for example, REA picked up a post from August 9 2005, instead of 2006).

So, the article isn't any new development, I guess. However, since I didn't post on it here at Watthead back in February (and I've already gotten this post written), I go ahead and post it anyway.]

Wave Energy Project in Portugal Awarded Funds

Finavera Renewables Limited's wholly owned subsidiary, AquaEnergy Group Ltd., has been successful in its application to the European Commission under the Framework Protocol 6 (FP6) program, RenewableEnergyAccess (REA) reports.

Finavera Renewables Limited's wholly owned subsidiary, AquaEnergy Group Ltd., has been successful in its application to the European Commission under the Framework Protocol 6 (FP6) program, RenewableEnergyAccess (REA) reports.

As a result, the European Commission may contribute up to Euro 1.37 million [US$1.75 million] toward the deployment of a 2 megawatt (MW) full-scale wave-energy power plant off the coast of Portugal, subject to successful contract negotiations and completion of the internal, formal selection process.

According to REA, the proposed power plant will be situated in 60 meters of water approximately 10 kilometers off the coastline midway between the Portuguese cities of Lisbon and Porto. Once successful operation of the plant has been demonstrated, the plant generating capacity is expected to be increased to 100 MW - enough electricity to power more than 60,000 homes.

"This award reflects the last four years of work that the team has put into the project," said Alla Weinstein, CEO of AquaEnergy. "With our partners, Dunlop Oil and Marine, Portuguese engineering group Kynamar and Labelec, a division of the Portugal's largest utility - Energias de Portugal (EDP) - we will begin executing our deployment plan once negotiations with the European Commission and the partners are completed."

"The Portuguese groups in particular have been very supportive," said Weinstein, "as they see the long term value in building a wave technology industry. It has been estimated recently that the country's coastline contains enough exploitable energy to contribute up 20% of the country's total electricity consumption - a total value of over Euro 5 billion [US$6.3 billion]."

"We are looking towards the future where wave power generation will join the commercial realm along with other types of renewables like wind energy," said Jason Bak, CEO of Finavera Renewables. "Recent technological advances are moving wave energy forward to a cost competitive renewable source of electricity. Not only does this award assist us in deploying our AquaBuOY technology at a true commercial scale, but along with our 1 MW Makah Bay project in Washington, USA, we can now start to look at building a pipeline of other projects worldwide."

Well this should help kickstart AquaEnergy's wave energy projects, both in Portugal and elsewhere. As Finavera's CEO, Jason Bak, mentioned above, AquaEnergy is also developing a 1 MW project in Makah Bay off the Northwestern tip of Washington's Olympic Penninsula. The funding for their Portugese project will help them prove their technology, and if the project expands to 100 MW, will help AquaEnergy build a supply chain that will bring down their costs and further spur the development of other wave energy projects, including Makah Bay.

AquaEnergy's CEO, Alla Weinstein, spoke at the recent Ocean Renewable Energy Conference in Newport on AquaEnergy's efforts, including the Makah Bay and Portugal projects. A summary of that conference can be found here.

Portugal seems to be setting itself up as the European proving grounds for wave energy companies, with both Ocean Power Delivery, and now AquaEnergy, deploying their first commercial projects in Portugese waters. Scotland is also competing to become the center of the emerging European ocean energy industry, and if Oregon is smart (and the efforts of local ocean energy boosters pays off), it could become the center of the North American ocean (or at least wave) energy industry.

The ocean energy industry is going to be fun to watch over the next four or five years, as a number of companies get their first projects in the water, and try to expand to truly utility scale projects (i.e., in the 10s to 100s of megawatts). This truly is the birth of a new renewable energy industry, and I for one welcome this new addition to our toolbox of renewable energy resources.

Eat Your Chocolate - It Could Be a New Source of Renewable Energy

[OK, I got a chuckle out of this one; from Renewable Energy Access:]

[OK, I got a chuckle out of this one; from Renewable Energy Access:]

Research from the University of Birmingham in the UK suggests that by indulging in chocolate, we could be contributing to a new source of renewable energy. Scientists at the University's School of Biosciences have found a way to extract hydrogen from confectionery waste -- a process that could have a major impact on the future handling of food waste and its potential as a supplier of renewable energy.

Using E. coli bacteria, identified by the researchers as having the right sugar-consuming, hydrogen-generating properties, a fermenter is set up containing the bacteria along with the caramel-like waste product and a gas such as nitrogen. Under these conditions, the E. coli ferments the sugars, generating a range of organic acids. To alleviate this toxicity in their environment they convert formic acid to hydrogen. Hydrogen is one of the cleanest fuels available and when used to power a fuel cell, the only byproduct is water.

The hydrogen generates clean electricity via a fuel cell. Thus, food factories could use their own product waste to generate energy for the manufacturing process; they might even be able to fuel their own vehicles from the hydrogen generated in this way. And it's a technology that could be adapted for use with most forms of food waste, making it internationally applicable.

There. Our energy problems are solved... just eat your chocolate!

Wednesday, August 09, 2006

Verdant Accuses Competitor of 'Site Banking' Prime Tidal Energy Sites

[From Renewable Energy Access:]

[From Renewable Energy Access:]

Verdant Power LLC, builder of the first tidal-power project in the U.S., says a competitor is blocking access to prime sites by applying for permits with no intention of developing them. Oceana Energy Co. denies it is blocking development at any of the 12 sites where it has asked for permission to place tidal-power projects. Tidal energy uses the movement of waters in ocean channels to run turbines.

Verdant, based in Arlington, Virginia, describes its turbines as "underwater windmills.'' Sean O'Neill, president of the Ocean Renewable Energy Coalition, a trade group in Potomac, Maryland, said it is difficult to sort people who are tying up sites speculatively from those legitimately seeking locations that would be best suited for their technology. He declined to characterize Oceana's activities.

"Speculation, and the fact it could hold up a site for anywhere from three to six years, that certainly is not good for the industry,'' O'Neill said in an interview. "Any company that is banking sites should be tarred and feathered.''

In a July 3 filing with the Federal Energy Regulatory Commission (FERC), closely held Verdant compared Oceana's moves to the dot-com tactic of registering Internet domain names and holding them "for ransom." The company said it believes Oceana "intends to bank the sites and auction them off for its own private gain when tidal technology matures."

A preliminary FERC permit gives developers three years exclusive access to a site.

Fledgling Industry

Oceana will harm development of tidal energy "at a time when large institutional companies are beginning to invest in wave and tidal companies," Verdant said. "These investors most likely will pull their money, with a possible death-spiral effect on this fledgling industry."

Washington-based Oceana filed applications with the commission seeking permits for sites in Alaska, Washington, Massachusetts, Maine, New York and New Hampshire. The company already has a permit for a site in San Francisco Bay.

"We don't know at this point if we would go forward with developing one site or all of them," said Mike Hoover, general counsel for Oceana Energy. "The sites are worth nothing at this point to anyone.''

Most of the permits Oceana seeks are for sites identified as ideal for tidal power in reports funded by the utility industry's research organization, EPRI.

Site Finder

The commission has approved 11 preliminary permits for tidal energy since 2004, according to spokeswoman Celeste Miller. Another 22 permits are pending, she said.

Roger Bedard, ocean energy leader for EPRI and author of the EPRI reports, said the number of tidal project proposals has boomed since the reports were issued late last year and early this year.

"I think our feasibility study has something to do with it,'' he said.

Verdant said in its filing that Oceana is targeting sites identified in the EPRI report and has failed to propose any specific projects or technologies.

The company lacks "any reputation in the still relatively close-knit ocean energy community,'' Verdant said.

Verdant is preparing to install next month the first tidal energy facility in the U.S. in New York City's East River [previous post]. The test facility will provide 200 kilowatts of power. It could be expanded to 300 turbines capable of generating a total of 10 megawatts, enough power for about 8,000 average U.S. homes.

Oceana's founders include William Nitze, former assistant administrator in the Environmental Protection Agency and a former general counsel for Mobil Oil Corp. The former chairman of the White House Counsel on Environmental Quality, George Frampton Jr., told regulators in a July 18 filing that he is conducting due diligence on Oceana on behalf of "a major private equity fund interested in being the lead investor in Oceana.''

Resources:

This site banking issue was a frequent topic of discussion at the recent Ocean Renewable Energy Conference in Newport Oregon I attended [see previous post]. Another company (I'm not sure the name) has aparently been trying to file for prime wave energy sites off the coast of Oregon also identified in an EPRI report.

This site banking issue could be a real setback for the fledgling ocean energy industry, and is a major concern for legitimate ocean energy developers. One suggestion at the Conference was that the Oregon Department of Energy (ODOE) file preliminary permits for the prime wave sites located off the coast of Oregon in order to prevent speculators from banking the sites. ODOE would then cede the development rights to legitimate developers. I'm not sure if that strategy will be employed to protect wave energy sites from the kind of site banking that has apparently already locked down a dozen prime tidal energy sites.

And what's this crap from Oceana about "The sites [being] worth nothing at this point to anyone"? They clearly are worth something to legitimate developers like Verdant who want prime tidal energy locations to develop and turn a profit, while driving the nascent ocean energy industry forward. The fact they Oceana seems to think they aren't worth anything at this point indicates to me that they are in fact not interested in developing these sites, at least not anytime soon. If they were planning to develop them, I'd think they would consider the sites a bit more valuable...

I hope, for the sake of the industry, that Oceana is a legitimate developer with real plans to develop most of these sites in the next 3-5 years. If it turns out that they are simply speculators site banking prime sites, then, as OREC's Sean O'Neill aptly said, they should be tarred and feathered.

Million Solar Roofs Update - Bill Unanimously Passes CA Senate Committee

As Renewable Energy Access (REA) reports, California's solar industry continues to eek out gradual but notable victories this week in the state Senate where solar legislation hasn't historically fared so well.

As Renewable Energy Access (REA) reports, California's solar industry continues to eek out gradual but notable victories this week in the state Senate where solar legislation hasn't historically fared so well.

On Tuesday, the reincarnated Million Solar Roofs bill, Senate Bill (SB) 1, passed the Senate Energy Committee with a unanimous vote from all nine Democrats and Republicans present. The bill now moves to the Senate Floor for a final concurrence vote before heading to the governor's desk, REA reports.

At the end of June, the reincarnated SB 1 passed the state Assembly with strong support on a 43 to 15 vote [previous post].

The Million Solar Roofs bill, SB 1, contains three main policies intended to accompany the California Solar Initiative (CSI) established by the Public Utilities Commission through a regulatory proceeding in January, after SB 1 ran aground in the legislature last year.

The complementary CSI is a $3.2 billion fund providing rebates for a million solar roofs in Pacific Gas & Electric (PG&E), Southern California Edison and San Diego Gas & Electric (SDG&E) territories. The program is the nation's largest and aims to build 3,000 MW of solar power - the equivalent of six large power plants - on homes, businesses, farms and schools throughout the state.

The policies contained in SB 1 include:

Bernadette Del Chiaro, clean energy advocate for Environment California, says the bill allows California to take a step forward toward realizing the goal of building a million solar roofs and making California the "Saudi Arabia of the sun."

That being said, however, she was not pleased that including municipalities in the arrangement forced the overall funds to be shifted.

"By rolling back the California Solar Initiative by $800 million, SB 1 takes an unnecessary and unfortunate step backward," said Del Chiaro. "The responsibility for achieving the state's solar vision now rests heavily on the shoulders of Mayor Villaraigosa and the LADWP to make sure Los Angeles builds their share of the million solar roofs goal."

The hearing was held at the request of the chair, Senator Escutia, and other members of the committee given the significant changes made to the bill since the Committee passed the bill last year. The members who voted to approve SB 1 Tuesday were Senators Alarcon, Battin, Bowen, Cox, Dunn, Duttin, Escutia and Kehoe.

Jan McFarland, Executive Director of Americans for Solar Power (ASPv) and the PV Manufacturers Alliance (PVMA), says the bill could return to the Senate floor for its last required vote as early as Thursday, August 10. She says the measure is expected to pass this final Senate vote given strong support for the bill.

Tuesday, August 08, 2006

Energy From a Restless Sea - The NY TImes on Ocean Energy

[The New York Times ran this article on the nascent ocean energy industry last week, and it's worth a read if you're interested in ocean energy:]

[The New York Times ran this article on the nascent ocean energy industry last week, and it's worth a read if you're interested in ocean energy:]

There is more riding the waves here than surfers, thanks to a growing number of scientists, engineers and investors.

A group of entrepreneurs is harnessing the perpetual motion of the ocean and turning it into a commodity in high demand: energy. Right now, machines of various shapes and sizes are being tested off shores from the North Sea to the Pacific — one may even be coming to the East River in New York State this fall — to see how they capture waves and tides and create marine energy.

The industry is still in its infancy, but it is gaining attention, much because of the persistence of marine energy inventors, like Dean R. Corren, who have doggedly lugged their wave and tidal prototypes around the world, even during the years when money and interest dried up. Mr. Corren, trim and cerebral, is a scientist who has long advocated green energy and pushed through numerous conservation measures when he was chairman of the public energy utility for the city of Burlington, Vt.

Another believer in the technology is Max Carcas, head of business development for Ocean Power Delivery of Edinburgh. “In the long run, this could become one of the most competitive sources of energy,” said Mr. Carcas.

His company manufactures the Pelamis, a snakelike wave energy machine the size of a passenger train, which generates energy by absorbing waves as they undulate on the ocean surface.

With high oil prices, dwindling fuel supplies and a growing pressure to reduce global warming, governments and utilities have high hopes for tidal energy. The challenge now is turning an accumulation of research into a viable commercial enterprise, which for many years has proved elusive.

No one contends that generating energy from the oceans is a preposterous idea. After all, the “fuel” is free and sustainable, and the process does not generate pollution or emissions.

Moreover, it is not just oceans that could be tapped; the regular flow of tides in bodies of water linked to oceans, like the East River, hold promise too. In fact, it seemed like such a sensible idea that inventors started making the first wave of such generators centuries ago. Many operated like dams, trapping water and then releasing it after the tides fell. But they were outmoded with the rise of steam engines and other more efficient fuel sources.

Ocean energy had a brief revival when oil prices rose in the 1970’s, and prototypes were tested in Europe and China. But financing dried up when oil prices were low in the 1990’s, and advances in wind turbines and other renewable energy elbowed out tidal projects.

These days, wave power designs vary from machines that look like corks bobbing in the ocean to devices that resemble snakes pointing into waves. There are shoreline machines that cling, like limpets, to rocks.

Tidal power machines, in contrast, often come in the form of turbines, which look like underwater windmills, and generate energy by spinning as tides move in and out; some inventors also are testing concrete-and-steel machines that lie on the seabed and pipe pressurized water back to the shore.

Even big commercial power companies are joining the action. General Electric; Norsk Hydro, a Norwegian company; and the Germany power giant Eon have recently pledged money for new projects or investments in tiny marine energy companies.

“It is an untapped renewable energy source,” said Mark Huang, senior vice president for technology finance in General Electric’s media and communications business, which is financing marine projects. “There is no where to go but up,” Mr. Huang said. He added that solar or wind energy should be viewed “as a case study” for the direction marine energy could take.

Right now, wave power generators are being tested near the shores of New Jersey, Hawaii, Scotland, England and Western Australia. A long-awaited East River tidal turbine project is to start this fall, and Representative William D. Delahunt, Democrat of Massachusetts, has proposed that the United States follow in Britain’s footsteps to build an ocean energy research center, the country’s first, off the Massachusetts coast.

A handful of commercial projects are also in the works, including the world’s first “wave farm,” as the fields of machines are known, being installed off the north coast of Portugal. A field of tidal turbines is also being built off the shore of Tromso, Norway.

Britain could generate up to 20 percent of the electricity it needs from waves and tides, according to an estimate by a government-financed group here called the Carbon Trust. That is about 12,000 megawatts a day at current usage, or three times what Britain’s largest power plant produces now. In fact, England and Scotland have become experimental laboratories for ocean energy development. As reserves shrink and the offshore oil business in the North Sea winds down, governments are trying to capture the accumulated knowledge and transform oil industry jobs into other ways of generating energy.

One research center here in Newcastle is putting marine devices to the test in a wave pool, and another is deploying them in the roiling ocean off the Orkneys, the low islands off northernmost Scotland. The Scottish government has pledged to generate 18 percent of its energy from renewable resources by 2010.

If marine energy replaces the burning of some fossil fuels like coal, it can help reduce overall carbon dioxide emissions and possibly increase the diversity and security of energy supply, said John Spurgeon, a marine energy specialist in the British Department of Trade and Industry. Since 1999, the government has committed more than $47 million to research and development, $93 million to commercialize that research and additional money to bring the energy into the electrical grid, Mr. Spurgeon said.

No energy source is perfect, though, and marine energy developers are running into some hurdles. While such generators do not emit smoky pollutants or leave behind radioactive waste, the machines are not small or delicate, and can be an eyesore. To draw energy from the ocean, they often need to be rooted on sea floors relatively close to shore, or mounted on rocks on the shore — places that have not traditionally been used for energy generation.

And despite their green-friendly intentions, inventors are finding some of the stiffest resistance is coming from environmental groups.

Take the case of Verdant Power, Mr. Corren’s company, which has been trying for years to erect a small field of tidal turbines in the East River — a project that may finally get started this fall. Mr. Corren, the company’s technology director, first developed the turbines as part of a New York University project in the 1980’s and planned to attach them to the Roosevelt Island Bridge. [Image: A tidal turbine being lowered into the East River for testing in 2004. A $1.5 million sonar system is planned to monitor effects on fish populations.]

[Image: A tidal turbine being lowered into the East River for testing in 2004. A $1.5 million sonar system is planned to monitor effects on fish populations.]

After the school pulled the plug on the project, the design team spent years trying to find a new home. One executive even brought a prototype to Pakistan, but the data it collected was lost when the computers and instruments went missing.

Verdant embarked on a new East River turbine project in 2003, but it has taken two and a half years to get regulatory approval for the project from environmental agencies and the United States Army Corp of Engineers. The issue was not blocking the river to boat traffic, or how it would hook up to the electrical grid or even how it might mar the view, because it is mostly underwater. It was the fish population of the East River.

“We had eight fish biologists against it, and no one on the other side advocating for clean air” or other environmental issues, said Ronald F. Smith, the chief executive of Verdant Power. “You can see that the regulatory process is extremely biased towards doing nothing,” Mr. Smith said, adding that regulators were worried about complaints that could arise from any new projects.

To get approval, the company is installing $1.5 million in underwater sonar to watch for fish around the turbines “24 hours a day, 7 days a week,” and the data will be shown online, Mr. Smith said. Verdant Power executives warn against looking forward to a live “East River cam” that broadcasts the murky mysteries beneath the water. Sonar transmissions look more like fuzzy black and white television, they say, and besides they have seen “very, very few fish” on their visits to the river.

Ultimately, Verdant estimates it can generate 10 megawatts of electricity from the East River’s tidal flows — enough to power several thousand homes, though its test turbines will be used primarily to power a Gristedes grocery store on Roosevelt Island.

To date, studies on the effect of wave and tide machines on marine life have been sporadic and sometimes bizarre. For example, in one British trial, frozen fish were shot like projectiles onto a piece of metal that was supposed to estimate the effects of the turning blades of marine turbines.

Proper testing will involve putting some of these devices where they are not wanted, a problem reminiscent of the wind industry’s battle to construct new turbines. Some leading environmental advocates say that the issue is part of a larger wrenching change being thrust on the green movement.

“It’s a major psychological and cultural challenge for the environmental and conservation movement,” said Stephen Tindale, executive director of Greenpeace UK. “What we need to combat climate change is a complete transformation of our energy system, and that requires a lot of new stuff to be built and installed, some of it in places that are relatively untouched.”

But the potential of marine energy is too strong to ignore. For example, a recent report identified San Francisco Bay as being the largest tidal power resource in the continental United States. “There are tremendous resources for generating power along the northern coast of California,” said Uday Mathur, a renewable energy consultant to government agencies and private enterprises.

The biggest hurdle is creating a landscape for development “where these technologies can thrive,” he said, which includes a combination of government involvement, community support and of course the availability of financing.

“The situation is very similar to wind 15 years ago,” said John W. Griffiths, a former British gas executive and founder of JWG Consulting, which advises on renewable energy projects. He added: “We think that this is an industry waiting to happen.”

SunOpta and Celunol to Open U.S. Cellulosic Ethanol Demonstration Plant By Spring 2007

According to Ethanol Producer Magazine (EPM), Toronto, Ontario-based SunOpta Inc. has sold a continuous process system for the conversion of biomass-to-ethanol to Dedham, Mass.-based Celunol Corp (formerly BC International). The demonstration plant is scheduled to begin production by spring 2007.

SunOpta’s patented pretreatment and hydrolysis technology will prep and convert sugar cane bagasse and possibly hard wood waste to ethanol at a plant in Jennings, Louisiana. Celunol/BC International has been conducting research and development in Jennings with a small-scale pilot cellulose conversion system at an existing facility where much of the necessary infrastructure is already in place, EPM reports.

The SunOpta-designed system will only produce between 1.5 MMgy and 2 MMgy, and to produce much more than that will depend on Celunol’s downstream capacity and proportion of hardwoods to bagasse used for conversion, according to Murray Burke, vice president and general manager of SunOpta's BioProcessing Group. “We’ve been at this quite a while,” he told EPM, referring to recent conversion systems sales in the Netherlands, Spain and China, along with the 30-plus years Burke and his company have spent working toward developing its cellulose-to-ethanol technologies. The Jennings plant would be the first in the United States to use SunOpta's patented process. “It’s just been kicked to a new level,” Burke said.  BC International was renamed Celunol less than four months ago, Burke explained, and with four new venture capitalists on board the company is financially well-backed. The list of investors includes Vinod Khosla, founder of Sun Microsystems, who has heavily endorsed cellulosic ethanol as key to the future of transport fuels in the United States (and has kicked up quite a lot of controversy in the blogosphere in the process [that's three seperate links]).

BC International was renamed Celunol less than four months ago, Burke explained, and with four new venture capitalists on board the company is financially well-backed. The list of investors includes Vinod Khosla, founder of Sun Microsystems, who has heavily endorsed cellulosic ethanol as key to the future of transport fuels in the United States (and has kicked up quite a lot of controversy in the blogosphere in the process [that's three seperate links]).

The demo system is planned to be on-site in Jennings the first week in February 2007, EPM reports. “Another six to eight weeks after that they’ll be operational,” Burke told EPM, meaning a U.S. commercial demo plant will be producing ethanol from lignocellulosic materials by Spring 2007.

Burke said capital costs are “cut to the bone,” or minimized, when a company can utilize existing infrastructure, as Celunol is doing. The cellulosic ethanol industry is still in its infancy, Burke said, equating it to the starch-based ethanol industry in 1980. “With processes changing so rapidly, should we put large investments in things that are changing so fast?” he asked rhetorically. Companies should make use of infrastructures in place where capital costs can be minimized in order to integrate a cellulosic ethanol industry into commercialization faster and more economically, Burke said.

And so it begins...

Mexico's Largest Oil Field Could be Facing a Rapid Demise

[From the LA Times:]

[From the LA Times:]

Output at Mexico's most important oil field has fallen steeply this year, raising fears that wells there that generate 60% of the country's petroleum are in the throes of a major decline.

Production at Cantarell, the world's second-largest oil complex, in the shallow gulf waters off the shore of Mexico's southern Campeche state, averaged just over 1.8 million barrels a day in May, according to the most recent government figures. That's a 7% drop from the first of the year and the lowest monthly output since July 2005, when Hurricane Emily forced the evacuation of thousands of oil workers from the region.

Though analysts have long forecast the withering of this mature field [see this 2004 EnergyBulletin post, for example], a rapid demise would pose serious challenges for the world's No. 5 oil producer. The oil field has supplied the bulk of Mexico's oil riches for the last quarter of a century, and petroleum revenue funds more than a third of federal spending.

"Cantarell is going to fall a lot, and quickly," said independent consultant Guillermo Cruz Dominguez Vargas, a former executive with Mexico's state-owned oil monopoly, Petroleos Mexicanos, known as Pemex. "I can't imagine the strain on this society if there is nothing to replace it."

It would also be bad news for the United States, for which Mexico is the No. 2 petroleum supplier, behind Canada. And it could exacerbate tight global supplies that have kept oil at record prices.

The world's "elephantine" fields have already been bagged, forcing companies to hunt in ever-more-remote areas for smaller amounts of oil to feed burgeoning demand, according to Houston energy analyst William Herbert.

"Unfortunately, the era of low-hanging fruit … has really run its course," said Herbert, co-head of research at Simmons & Co. International, a Houston-based energy investment bank. He put the odds of finding another field the size of Cantarell in Mexico or anywhere else at "slim and none."

Exceeded in size only by Saudi Arabia's leviathan Ghawar field, Cantarell is a prolific giant that is past its prime. Monthly production peaked in late 2004 at just over 2.1 million barrels a day and has fallen more than 15% since then. Experts agree it has nowhere to go but down.

The multibillion-dollar question is just how quickly Cantarell will lose its productive capacity, and whether Pemex will be able to coax more oil out of existing fields to take up the slack while it searches for new deposits.

Pemex did not respond to requests for an interview. But officials publicly have downplayed prospects of a swoon in the media and in official releases. In fact, the company has projected that its overall oil output will increase slightly in 2006 to an average of 3.4 million barrels a day from 3.3 million daily last year.

The firm has done extensive maintenance on Cantarell to keep the oil flowing. In a December 2005 news release, Pemex predicted that the field will produce an average of 1.9 million barrels a day in 2006, a modest 6% drop from 2005, followed by double-digit annual declines that would reduce average production to 1.4 million barrels daily in 2008.

Other studies aren't so optimistic. Seawater is threatening to swamp the wells of Cantarell as the field's pressure diminishes, a debilitating symptom of old age that makes it tougher to extract the remaining oil. Leaked internal reports of Pemex's own worst-case scenarios published in Mexican newspapers show production plummeting to about 520,000 barrels a day by the end of 2008 — a 71% free-fall from May levels in less than three years.

Mexico City energy analyst David Shields said the swift drop over the first five months of 2006, and conversations with Pemex insiders have convinced him that prospects at Cantarell are worse than officials will admit publicly. June figures for the field won't be available until later this month. But Mexico's overall crude production fell in June, the third straight monthly decline, making it unlikely that Cantarell staged a revival.

"It's doing very badly," said Shields, general manager of Energia a Debate, an industry trade publication, and the author of two books on Pemex. "My reading of the situation is that it's dire."

Whether Cantarell's slide prompts changes in Mexico's oil sector remains to be seen. Critics have long lambasted state-owned Pemex as a hotbed of inefficiency and corruption that officials have treated more like an ATM than Latin America's largest company. But record oil prices have lessened the urgency to overhaul the company.

One would never suspect that trouble might be bubbling in Mexico's oil patch from the glut of petrodollars flooding its treasury. Federal officials last year siphoned $54 billion from Pemex to fund government spending that included a baseball stadium in Chihuahua and a gigantic flagpole in Nuevo Leon.

The trouble, analysts say, is that the government's take is so large that it has left little to reinvest in Pemex to keep the black gold flowing.

Despite record sales of $86.2 billion last year, the company lost $7.1 billion after taxes. It's the most indebted oil firm in the world, carrying a staggering $50 billion in loans on its books. Pipeline leaks and explosions are commonplace, in part because the monopoly lacks sufficient funds for basic maintenance of equipment. Proven reserves have tumbled by more than a third since 2000. Mexico buys a quarter of its gasoline from foreigners for want of refining capacity, the equivalent of Hawaiians importing pineapple.

Yet Pemex was not an overriding theme of the recent presidential contest. In fact, the three major candidates usually prefaced remarks about their energy plans with the assertion that the state-owned oil firm must never be privatized. Like Social Security in the United States, Mexico's government-controlled oil industry is the third rail of Mexican politics.

"No Mexican candidate ever earned a single vote by talking about reform in the energy sector," said analyst George Baker, a Mexico expert with Energia.com, a Houston-based consulting firm.

Mexico nationalized its industry in 1938 in response to decades of perceived exploitation by foreign oil interests. The belief that "el petroleo es nuestro" or "the oil is ours" is deeply embedded in the national psyche.

Cantarell is a particular source of pride. Named for a Yucatan Peninsula fisherman, Rudecindo Cantarell, who first noticed crude bubbling to the surface of the Campeche Sound in 1976, the field vaulted the nation into one of the world's oil powers and affirmed the ability of Mexicans to manage their own energy resources.

"We haven't had many successes in our history, but petroleum is one of them," said consultant Cruz.

But he and other experts say Mexico's go-it-alone strategy has become a liability at a time when the nation desperately needs billions in fresh capital to develop new fields. Mexico's constitution currently forbids outsiders from investing in the energy sector in exchange for a share of production, a global practice that has been embraced even by communist Cuba.

Some of the most promising potential reserves lie in the deep waters of the Gulf of Mexico. But that's an expensive undertaking for which Pemex lacks the technical expertise, funding and, perhaps most important — time — to bring new production along fast enough to offset Cantarell's descent.

"Once Cantarell rolls, conventional wisdom has it that it would roll hard and that the declines would be steep," analyst Herbert said. "It looks like that may be what we're seeing."

As Devilstower at the DailyKos points out, the demise of Cantarell isn't just a big deal for Mexico, but will impact the United States considerably as well: The fall of Cantrell will tighten another notch in oil's already snug supply-side belt. With rising demand and supply from its friendly southern neighbor falling, the US will find itself competing ever more heavily for oil that's increasingly sourced in the Middle East. The US gets more oil from the Cantrell complex alone than it now gets from Iraq.

This will certainly change if Cantarell's decline follows the path described above.

And as the graphic above illustrates, the kind of decline occuring at Mexico's Cantarell field is symptomatic of the world's aging giants: all of the world's top three oil fields - Saudi Arabia's Gawar field (the world's largest), Kuwait's Burgan field (see previous post) and Mexico's Cantarell - are at or past their peak, and it's highly unlikely that similarly large fields will be discovered to replace these 'crown jewels' of the oil industry.

$100/bbl oil, here we come...

Monday, August 07, 2006

News From My Backyard: Oregon Governor Wants to Increase Business Energy Tax Credit, Urges Move Towards Hydrogen Economy

Businesses that invest in alternative energy sources and energy efficiency should get increased tax credits, Gov. Ted Kulongoski told advocates of a group promoting hydrogen energy sources, last Monday.

Businesses that invest in alternative energy sources and energy efficiency should get increased tax credits, Gov. Ted Kulongoski told advocates of a group promoting hydrogen energy sources, last Monday.

Kulongoski, who is running for re-election, told the Northwest Hydrogen Conference that he wanted Oregon to move toward a hydrogen economy, and to become a center for fuel-cell production, according to an AP report.

The proposed increase [to Oregon's Business Energy Tax Credit] would cost the state an estimated $6.5 million in the 2009-11 budget cycle but could also translate to more business investment and less reliance on fossil fuels, Michael Grainey, the state's energy director, told The Oregonian.

The governor's proposal would increase the maximum tax credit for an energy project from $3.5 million over five years to $10 million over five years. It would also allow companies to claim a tax credit for 50 percent of the project cost, up from 35 percent under current law.

Oregon's Business Energy Tax credit has been very succesful at spurring investment in energy efficiency and distributed renewables in Oregon. Kulongoski's proposal would make this key incentive even stronger and would make investing in solar photovoltaics, energy efficient lighting upgrades, solar hot water and other energy efficiency and renewable energy improvements an attractive venture for Oregon businesses.

Info on the Business Energy Tax credit can be found here and here

[I missed this short article in the Oregonian, but it came to me via Autoblog Green]

BP Shuts Down Prudhoe Bay Oil Field Due to "Severe" Pipeline Corrosion

[This just in from the New York Times:]

[This just in from the New York Times:]

As BP continued working today to shut down the huge Prudhoe Bay oil field in northern Alaska after finding “unexpectedly severe corrosion” in a pipeline, company executives would not say how long they expected the facility to be out of commission.

Taking the field off line will reduce domestic oil production by 400,000 barrels a day, or 8 percent — equivalent to about one-third of the amount the United States imports daily from Venezuela. With demand for energy now high and production capacity already stretched, the shutdown raises the possibility that the Energy Department may release oil from the nation’s strategic petroleum reserve.

Bob Malone, president of BP America, said in a news conference today that the company “will not commit to a date” for restoring oil production in Prudhoe Bay. But Mr. Malone added that BP will look for a way to quickly get oil flowing safely from at least some of the field, to limit the impact on the nation’s oil supply.

The shutdown is the latest in a string of embarrassments for BP, which has suffered from a host of safety, environmental and regulatory problems in recent months, including a large oil spill at Prudhoe Bay earlier this year [see previous post].

In the news conference, Mr. Malone issued an apology. “BP deeply regrets that it’s been necessary for us to take this drastic action,” he said . “On behalf of the BP Group, I apologize for the impact this has had on our nation.”

Word of the shutdown rattled global commodities and equities markets. In the United States, oil prices rose more than a dollar a barrel in early trading, with the benchmark contract for light, sweet crude delivered next month rising nearly to $77 a barrel. In London, spot prices rose as much as 2 percent on the news, to almost $78 a barrel.

Stocks, meanwhile, fell in American trading and slid across Europe. Major indexes in Britain, Germany and France all posted substantial declines for the day.

Craig Stevens, a spokesman for the Energy Department, said this morning that oil could be released from the reserve if refiners request it, but that none had done so yet. According to Mr. Stevens, Samuel W. Bodman, the Secretary of Energy, has instructed his staff to reach out to BP and to be prepared if the company or any other refiners ask the department to tap the reserves. If such a request is approved, stored oil can be flowing within 24 to 48 hours, Mr. Stevens said.

BP said that inspections of its facilities at Prudhoe Bay over the weekend had found pipeline walls in more than one location that had been made too thin by corrosion to meet the company’s safety standards. In one area, it said, the equivalent of four to five barrels of oil had already leaked out of the pipeline and spilled on the tundra.

BP said that spill had been contained, and that workers were in the process of cleaning it up.

The company is still inspecting other pipelines and production facilities at the field. So far, BP said this morning, 40 percent of the company’s 22 miles of pipeline in Prudhoe Bay had been completely inspected.

In March, pipeline corrosion caused a leak of more than 200,000 gallons of oil, the worst spill since production began on Alaska’s North Slope [see previous post]. The incident raised questions about whether BP, based in Britain, had been properly maintaining its aging oil production network there, which it acquired when it merged with Amoco in 1998.

The latest corrosion problem was detected during an inspection that the government required BP to perform after the March oil spill. A “smart pig” examination, using a machine that travels through the inside of a pipeline to measure wall thickness, revealed that the steel had corroded in 16 places to thicknesses less than BP considers safe.

Daren Beaudo, a BP spokesman, said that for the pipeline in question, safety standards require that at least 70 percent of the steel in a 3/8-inch-thick wall must be intact.

The problems at Prudhoe Bay are also likely to add to the debate about whether to expand oil drilling on the North Slope. In May the House voted to approve drilling for oil and gas in the Arctic National Wildlife Refuge. But in the Senate, where support for drilling in the reserve is not as strong, efforts to pass similar legislation have failed.

Last year, an explosion at a BP refinery in Texas killed 15 workers, raising questions about the company’s compliance with government regulations. The company is also under investigation over suspicions that it manipulated propane prices.

Thursday, August 03, 2006

New York State Plans to Convert 600 State Vehicles to Plug-in Hybrids

New York Governor George E. Pataki and Senate Majority Leader Joseph L. Bruno announced plans for a new $10-million State program to convert vehicles in the State fleet to plug-in hybrids and for the construction of a state-of-the-art alternative fuel research laboratory at the Saratoga Technology + Energy Park (STEP).

New York Governor George E. Pataki and Senate Majority Leader Joseph L. Bruno announced plans for a new $10-million State program to convert vehicles in the State fleet to plug-in hybrids and for the construction of a state-of-the-art alternative fuel research laboratory at the Saratoga Technology + Energy Park (STEP).

Under the $10 million plug-in hybrids program, the 600 hybrid vehicles in the State fleet will be retrofitted to be plug-in hybrids. Once the State’s hybrid vehicles have been converted to plug-in hybrids, the program will be made available to private vehicle owners through a competitive process.

The New York State Alternative Fuel Vehicle Research Laboratory will conduct testing for advanced and emerging technologies such as fuel cell propulsion systems, alternative fuels, and greenhouse gas reduction technologies. Special focus will be on test systems to quantify all emissions from diesel buses and trucks, which will help to develop advanced control and retrofit technologies for these vehicles.

The laboratory also will promote public-private partnership projects and educational programs, including research grants, technology development, and technician training applicable to emerging technologies such as alternative fuel concepts.

Governor Pataki: This year, New York State has taken significant steps to reduce our dependence on imported energy, and we will continue to promote cutting-edge research and technology that will build a brighter energy future here in the Empire State. This new vehicle testing laboratory and our investments in plug-in hybrids are critical to this effort, and will help spur the innovation necessary to transition away from a petroleum-based transportation sector.

The Governor also announced that Electrovaya, a Canadian high-tech battery manufacturing firm, plans to expand Canadian operations into 5,000 square feet of manufacturing space at STEP, with additional expansion planned. The company’s lithium-ion batteries can be used in a variety of products and applications, including electric vehicles [see this Green Car Congress post for more]

Bravo to New York for this action. This will help provide a market for plug-in conversion kits and hopefully convince one or more big car companies (Toyota and DCX, I'm looking at you) to get at least one plug-in hybrid model to market (for fleet sales, at least).

Along with the Plug-in Partners Coaltion and it's member cities, a sizable fleet-sales market is just sitting out there waiting for the first mass-market PHEV to be released. If I were somebody like Toyota, with their large hybrid components supply chain, or DCX with their work with EPRI on PHEVs (their Sprinter PHEV vans are in field testing right now, see previous post), I'd be rushing to corner that market. Hopefully somebody in their organizations thinks like me...

[A hat tip to Green Car Congress - again]

US DOE to Invest $250 Million in New Biofuels Research Centers

The US Department of Energy (DOE) will spend $250 million to establish and operate two new Bioenergy Research Centers to accelerate basic research on the development of cellulosic ethanol and other biofuels from biomass, including biodiesel, biofuels for aviation, and biologically based hydrogen and other fuels from sunlight.

The US Department of Energy (DOE) will spend $250 million to establish and operate two new Bioenergy Research Centers to accelerate basic research on the development of cellulosic ethanol and other biofuels from biomass, including biodiesel, biofuels for aviation, and biologically based hydrogen and other fuels from sunlight.

The centers’ mission will be to conduct systems biology research on microbes and plants. A major focus will be on understanding how to reengineer biological processes for more efficient conversion of plant fiber, or cellulose, into ethanol, a substitute for gasoline.

Research Centers will address scientific problems that are inherently interdisciplinary and will require scientific expertise and technological capabilities that span the physical and biological sciences, including genomics, microbial and plant biology, analytical chemistry, computational biology and bioinformatics, and engineering.

Examples of possible research areas include:

Secretary of Energy Samuel Bodman:

This is an important step toward our goal of replacing 30 percent of transportation fuels with biofuels by 2030. The Energy Policy Act of 2005 (EPAct) calls for the creation of new programs to improve the technology and reduce the cost of biofuels production. The mission of these centers is to accelerate research that leads to breakthroughs in basic science to make biofuels a cost-effective alternative to fossil fuels.The US currently produces about four billion gallons of ethanol, mainly from corn. EPAct requires that by 2012, at least 7.5 billion gallons per year of renewable fuel be blended into the nation’s fuel supply. To meet these goals, future biofuels production will require the use of more diverse feedstocks including cellulosic material such as agricultural residues, grasses and other inedible plants.

Universities, national laboratories, nonprofit organizations and private firms are eligible to compete for an award to establish and operate a center. To minimize the start-up costs and significantly decrease the time required for the Centers to become operational, the Centers will be established through renovating or leasing existing buildings rather than new construction.

Awards, based on evaluation by scientific peer review, will be announced next summer. The centers are expected to begin work in 2008 and will be fully operational by 2009.

The announcement of the Bioenergy Research Centers initiative culminates a six-year-long effort by the DOE Office of Science to lay the foundation for breakthroughs in systems biology for the cost-effective production of renewable energy.

In early July, DOE’s Office of Science issued a joint biofuels research agenda with the Department’s Office of Energy Efficiency and Renewable Energy titled Breaking the Biological Barriers to Cellulosic Ethanol [see previous post]. The report provides a detailed roadmap for cellulosic ethanol research, identifying key roadblocks and areas where scientific breakthroughs are needed.

The proposal deadline for this funding opportunity is February 1, 2007. DOE’s Office of Science will provide $25 million in the first year for the establishment of each center and up to $25 million per year for the following four years to support the operations of each center for a total award of up to $125 million per center.

Resources:

Well, this is a start...

I hope that this government-funded research (and hopefully there's more like this to come) serves a supporting role to industry to speed the time-to-market of cellulosic ethanol and doesn't retread the considerable amount of work already done by the private sector.

These new research centers will perform 'basic' research on biofuels, which will hopefully yield new improvements to the existing processes for cellulosic ethanol and other biofuels production. And, as with any basic research, it will likely yield a few new surprises.

[A hat tip to Green Car Congress]

Read more!

News From My Backyard: PSU and Others to Host New Flexcar for Undergrads Car-Share Program

Flexcar is piloting a new program for college students between the ages of 18 and 20 at six universities across the US. The first campuses will include the University of Portland (Oregon), University of California-Los Angeles, University of California-San Diego, University of California-Berkeley, University of Maryland and Emory University (Atlanta).

Flexcar is piloting a new program for college students between the ages of 18 and 20 at six universities across the US. The first campuses will include the University of Portland (Oregon), University of California-Los Angeles, University of California-San Diego, University of California-Berkeley, University of Maryland and Emory University (Atlanta).

Campus parking for privately-owned cars is typically very limited, and rental car companies traditionally only rent to licensed drivers 25 and older. Even car-sharing, which has been rapidly expanding on college campuses, has been restricted to those 21 and older.

Based on the results of the pilot, Flexcar may partner with more campuses in the Fall.

Flexcar is already providing car-sharing services to faculty and staff at colleges and universities. Many campuses offer Flexcar as a commuting enhancement service to encourage faculty and staff to leave their cars at home, using Flexcar for personal errands during the day. Other campuses rely on Flexcar for university-related business travel, such as meetings, seminars and other trips.

The company is working through the many challenges associated with what the insurance industry generally considers the highest-risk driver group: those under 21. Nonetheless, Flexcar officials feel it is important to extend the personal, environmental and community benefits to this segment of the driving population.

Students at these universities must meet certain eligibility requirements in order to participate in the program, including a clean driving record, supplemental insurance and parental approval. They also must pay a refundable deposit.

Flexcar operates car-sharing programs for more than 35,000 members in eight metropolitan areas, covering nearly 40 cities in seven states and the District of Columbia. Flexcar’s fleet includes sedans, gas-electric hybrids, and specialty vehicles including pickups, AWD, minivans and convertibles.

Resources:

[A hat tip to Green Car Congress]

Tuesday, August 01, 2006

Northwest Wheat Farmers Squeezed by Rising Production Costs - Renewables Can Help

Rising production costs are squeezing Northwest wheat farmers, according to the Sustainable Industries Journal (SIJ).

Rising production costs are squeezing Northwest wheat farmers, according to the Sustainable Industries Journal (SIJ).

Across the country, rising fuel and fertilizer costs have dampened the acreage of wheat planted, with more farmers now planting soybeans instead. Wheat growers in Oregon and Washington already face the highest production costs in the country, SIJ reports, in large part because of irrigation demands and land value.

On top of these already high costs, rising costs for fertilizer and other costs of production are putting the squeeze on already thin profit margins for the Northwest's wheat farmers.

Fertilizer costs have shot up 35 percent in the last year, said Fred Fleming, a founder of the Food Alliance-certified Shepherd’s Grain cooperative in Washington. “It’s a heck of a concern,” he said. Many farmers are facing costs that far outstrip current market prices for their crop, and without change many could be forced to shut down, Fleming said.

Many Northwest wheat farmers turned to cooperatives, like Fleming's Shepherd's Grain coop in Washington, for the increased value their product certification programs can provide. But these coops can only grow so big, so fast, and many farmers are being turned away.

“We have to develop the market,” Fleming said. “The last thing I want to do is bring a bunch of farmers in but not be able to produce the market. Then they sit and lose market opportunities that are out there right now to sell their crop.”

As an alternative, some wheat growers have applied to put most or all of their acreage into the Conservation Reserve Program, Fleming said. He estimates roughly 250,000 acres of land are being considered for the program, but it only has space for about 8,200 acres.

“I think this tells you that the farmers - especially farmers in their mid 50s and up - are looking for any way they can farm and know for 10 years they’ll have a living income,” Fleming said. “There is a lot of anxiety out here, more so than I have seen in past years.”

Despite the fact that that Northwest is home to less than 10 percent of U.S. wheat farms, wheat is one of the leading commodity crops in both Oregon and Washington, valued at upwards of $700 million in 2005.