According to an article from PhysOrg, the potentially huge deposits of energy resources beneath the melting Arctic ice cap is moving to the fore in the international scramble for new energy supplies.

According to an article from PhysOrg, the potentially huge deposits of energy resources beneath the melting Arctic ice cap is moving to the fore in the international scramble for new energy supplies.

According to PhysOrg, analysts and key industry figures addressing the recent World Economic Forum in Davos, Switzerland, argued that unlocking the region's potential could help ease global concerns over assured energy supplies.

Obviously, difficult questions remain about the impact on the environment and the uncertainty of exactly who owns what, with up to eight countries claiming some interest in the Arctic and others racing to catch up presents additional difficulty.

The PhysOrg article continues: "It will never replace the Middle East" as an oil source, said Helge Lund, head of Norway's Statoil energy group, but "it has the potential to be a good supplement."

Lund said the Arctic may account for as much as 25 percent of undiscovered oil and gas resources worldwide, the equivalent of 375 billion barrels.

Analysts say the Arctic is highly attractive because it is closer to Europe and the United States, reducing transportation costs, and offers the prospect of more stability and supply security than the volatile Middle East.

Moreover, global warming has reduced Arctic sea ice -- which last year was the lowest on record -- and opened the way for increased marine transport and access to natural resources.

George Newton, chairman of the US Arctic Research Commission, said surface temperatures were set to rise up to 5.5 degrees within a century even without taking the impact of booming economies such as China and India into account.

He predicted tourist and commercial maritime traffic through the fabled and normally ice-locked Northwest Passage within a decade.

Even China, he added, was showing an increasing interest in Arctic research and had recently bought an icebreaker.

European Union energy commissioner Andris Piebalgs said Brussels wanted to diversify its energy suppliers. Currently, a quarter of its natural gas comes from Russia, and 15 percent from Norway.

"We regard Russia in the future as a reliable supplier," he said, but that did not mean the European Union should not seek alternatives.

"We should be more concerned about situations where there is disruption of supply."

Lund said that if Barents Sea resources could be successfully exploited, a new gas pipeline could be attached to existing pipelines serving Europe.

He said concerns over the environmental impact of increasing use of Arctic resources could be allayed by new technologies such as sub-sea facilities that would not harm fish and other marine stocks.

"Often people under-estimate the power of technology" to cope, Lund added, calling for a single management regime for all the Arctic's natural resources on the basis that "neither fish and hydrocarbons know boundaries."

But that touches on another tricky issue -- deciding which country owns or can exploit which parts of the Arctic.

Eight nations -- Canada, Denmark (via Greenland), Finland, Iceland, Norway, Sweden, Russia and the United States -- have Arctic interests.

Of those, all bar Sweden and Finland enjoy Arctic coastlines, and border and sovereignty disputes, such as between Russia and Norway, Russia and the United States and the United States and Canada, are hampering cooperation.

A country is permitted 200 nautical miles under the Law of the Sea for its territorial waters, but can also lay claim to extra mileage on the continental shelf -- essential to explore and utilise sub-sea energy resources.

"I don't see any geopolitical tensions arising out of the Arctic," Piebalgs said, although Newton pointed out that unlike Russia, the United States still had not ratified the treaty.

This is yet another sign that concerns about resource depletion are leading the world's industrial nations (as well as rapidly industrializing nations like China and India) to search in some unlikely places for new energy resources.

What strikes me as extremely ironic about this new focus on Arctic energy resources is that they are becoming accesible due to global climate change (which is particularly pronounced in the low latitudes). That is, our fossil energy use is fueling global climate change that is melting Arctic sea ice and unlocking more fossil energy resources for us to use which will continue to fuel global climate change. Does this sound like a particularly smart strategy?

Wouldn't we be much better off turning to renewable and clean energy resources with a greater focus on the development of wind, solar, geothermal and biomass technologies as well as energy storage technologies (to help overcome the intermittency of these renewable energy sources)? Wouldn't it make more sense to reduce our demand for fossil energy through energy efficiency and conservation than to begin to exploit the fragile and hard to access Arctic Ocean region?

Monday, January 30, 2006

Could the Arctic be the Next Middle East?

Top NASA Climate Scientist Says Bush Administration Tried to Silence Him on Global Climate Change

PhysOrg reports that NASA's top climate scientist, James Hansen, has accused the Bush administration of trying to stop him from speaking out after he called in a lecture for swift cuts in emissions of the greenhouse gases linked to global warming.

Hansen, the director of the US space agency's Goddard Institute for Space Studies, said that officials at NASA headquarters had ordered the public affairs staff to review his forthcoming lectures, papers, postings on the Goddard website and requests for media interviews, the New York Times reported Sunday.

"They feel their job is to be this censor of information going out to the public," said Hansen, who told the paper he would ignore the restrictions.

The article continues: Dean Acosta, deputy assistant administrator for public affairs at NASA, denied to the Times that there was any effort to silence Hansen.

"That's not the way we operate here at NASA," Acosta said. "We promote openness and we speak with the facts."

Acosta said that government scientists were free to discuss scientific findings but that policy statements should be left to policy makers and appointed spokesmen.

"This is not about any individual or any issue like global warming," he told the Times. "It's about coordination."

"Since 1988, (Hansen) has been issuing public warnings about the long-term threat from heat-trapping emissions, dominated by carbon dioxide, that are an unavoidable byproduct of burning coal, oil and other fossil fuels. He has had run-ins with politicians or their appointees in various administrations, including budget watchers in the first Bush administration and Vice President Al Gore," the Times reported.

Hansen told the Times that "efforts to quiet him" had begun in a series of calls after a lecture he gave on December 6, 2005, at the annual meeting of the American Geophysical Union in San Francisco.

"In the talk, he said that significant emission cuts could be achieved with existing technologies, particularly in the case of motor vehicles, and that without leadership by the United States, climate change would eventually leave the earth 'a different planet'," the Times said.

US administration policy is to use voluntary measures to slow, but not reverse, the growth of emissions.

"After that speech and the release of data by Dr Hansen on December 15 showing that 2005 was probably the warmest year in at least a century, officials at the headquarters of the space agency repeatedly phoned public affairs officers, who relayed the warning to Dr Hansen that there would be 'dire consequences' if such statements continued, those officers and Dr Hansen said in interviews," the Times said.

In discussions with the daily paper, Hansen said "it would be irresponsible not to speak out, particularly because NASA's mission statement includes the phrase 'to understand and protect our home planet'".

It added that he was "incensed that the directives had come through telephone conversations and not through formal channels, leaving no significant trails of documents".

The Times quoted Hansen's supervisor, Franco Einaudi, as saying there had been no official "order or pressure to say shut Jim up".

"That doesn't mean I like this kind of pressure being applied," he told the paper.

This seems perfectly in keeping with the Bush administration's stance on global climate change. The administration's past record on editing (i.e. censoring) reports on global warming makes claims like this seem more credible and Bush et. al. have repeadetly tried to downplay global climate change while taking very little action to address its causes or mitigate its consequences.

When are we going to see some real leadership on climate change from the federal level?

Friday, January 27, 2006

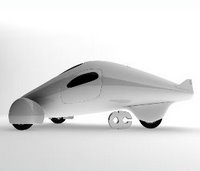

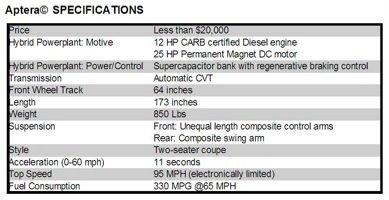

Move Over Insight - Here Comes the 330 mpg Diesel-Electric Hybrid Aptera

Three San Diego engineers have designed a two-passanger, three-wheeled diesel-electric parallel hybrid that will achieve a phenomenal 330 mpg while selling for less than $20,000 (USD).

Three San Diego engineers have designed a two-passanger, three-wheeled diesel-electric parallel hybrid that will achieve a phenomenal 330 mpg while selling for less than $20,000 (USD).

The engineers have formed a company, Accelerated Composites, LLC, (AC) to refine the design and build a prototype.

According to a press release, the innovative vehicle, dubbed the "Aptera," will be constructed from composite, light-weight materials, will post this fuel efficiency in normal city and highway driving and will demonstrate acceleration and handling similar to that of a Honda Insight.

The vehicle achieves these remarkable numbers through the use of cutting-edge materials, manufacturing methods, and a maverick design mantra. AC's slogan is "Innovation in Orders of Magnitude" and seems appropriate considering the reported specs of the Aptera.

The press release goes on: Unique, optimized aerodynamics gives the Aptera© a drag form factor that will be lower than any mass produced car in the world. “It looks like nothing you’ve ever seen because it performs like nothingyou’ve ever seen,” says Accelerated Composites founder and CEO Steve Fambro. “What we’ve done is changed the way cars are thought of and designed. Rather than designing to a styling aesthetic, like the big auto makers do, we hew to an efficiency and safety aesthetic. When you do that, math and physics mostly dictate the shape of the car, and in this case, math and physics look awesome.”

But aerodynamics is only half of the equation. The other half is weight.  The Aptera© is made almost entirely of lightweight composites, making it one of the lightest cars on the road. Yet this savings does not come at the cost of safety. In fact, the construction of the car is based on the driver-protection “crash box” found in Formula One race cars. “Composites are enormously strong and lightweight,” says Fambro. “That’s why all the aircraft manufacturers are switching to them.”

The Aptera© is made almost entirely of lightweight composites, making it one of the lightest cars on the road. Yet this savings does not come at the cost of safety. In fact, the construction of the car is based on the driver-protection “crash box” found in Formula One race cars. “Composites are enormously strong and lightweight,” says Fambro. “That’s why all the aircraft manufacturers are switching to them.”

So why aren’t the auto makers switching? “Cost” says Fambro. "They haven’t figured out cost-effective manufacturing processes for composites. But we have."

The Aptera will weigh only 850 pounds and, as mentioned above, is made almost entirely of lightweight composites, based on AC’s Panelized Automated Composite Construction (PAC2) process.

The light weight and three-wheel design means the Aptera will be liscenced as a motorcycle.  The production model of the vehicle will pair a 12 horsepower (hp) CARB-certified diesel engine with a 25 hp permanent magnet electric motor and will be able to run in all-electric mode (AC is designing the prototype with a gasoline engine for cost). AC plans to use ultracapacitors for energy storage and regenerative breaking. Ultracaps are not chemical batteries and thus can quickly and efficiently accept the energy from regenerative breaking. They also offer very high power densities (albeit with correspondingly low energy densities).

The production model of the vehicle will pair a 12 horsepower (hp) CARB-certified diesel engine with a 25 hp permanent magnet electric motor and will be able to run in all-electric mode (AC is designing the prototype with a gasoline engine for cost). AC plans to use ultracapacitors for energy storage and regenerative breaking. Ultracaps are not chemical batteries and thus can quickly and efficiently accept the energy from regenerative breaking. They also offer very high power densities (albeit with correspondingly low energy densities).

The Aptera will feature an automatic continuously variable transmission (CVT) and will be able to accelerate from 0-60 in 11 seconds with a electronically regulated top speed of 95 mph.

To increase aerodynamics, the slippery vehicle will not have side mirrors but will rather incorporate video cameras and a rear view display inside the vehicle. All told, the aerodynamics of the Aptera are practically an order of magnitude better than anything on the road today and AC claims that the coefficient of drag on the vehicle will be only 0.055-0.06.

The initial response by many to this design (myself not exluded, see lengthy discussions here and here) is that it could never pass safety standards or that it is too unsafe to drive on the same roads as SUVs and semis.

While I certainly wouldn't love to get hit by a semi in this car - not too different from any other car really - as AC's founder and CEO, Steve Fambro, quickly pointed out, such criticism is a bit misplaced. Indeed, the Aptera is being designed with the full intent of making it a safe and liscencable vehicle. As Fambro writes: "The Aptera will be treated as a motorcycle in the eyes of the law, but that doesn't mean it's unsafe. On the contrary, it will have the same type of airbag-in-seatbelt technology used in newer light planes. Additionally, the dirver and passenger sit in a 'crashbox' thats underneath the aeroshell...or body. There's crushable/absorbing material between the aeroshell and body as well. The crashbox design, still being modeled and simulated, offers much more protection than most car doors/pillars."

Furthermore, while composites may be light, they aren't brittle and actually have strengths similar to steel.

In short, we're not talking about a fiberglass tin can here, but rather a composite shelled vehicle with an inner crashbox modeled after those used by forumala race cars, a crushable/absorbing material and airbags protecting the driver and passanger. So while you're car may be totalled in an accident with an SUV, you'll walk away fine (can the SUV driver say the same?

Furthermore, millions of people the world over ride motorcycles while plenty of us treehuggers feel safe enough riding your bikes everywhere. Why wouldn't you feel safe enough to ride around in a vehicle surrounded by a composite shell and protected by a 'crash box' modeled after those in a formula racer? (We've all seen those spectacular high-speed, end-over-end race car crashes from which the driver walks away a bit bruised but otherwise unhurt).

Finally, plenty of people got excited about the Honda Insight and I can't imagine that the Aptera is any less safe than the Insight which is about the same size and made of similar ultra-light materials.

In the end, the most exciting part about this vehicle is that it pushes the limits of what we think is possible for a vehicle to obtain. 330 mpg! How can we get excited about GM's 70 mpg boxfish-styled diesel concept (also with video instead of side mirrors for aerodynamics) when this baby is out there?

Even if this vehicle never makes it on the roads (and I dearly hope it does), or if when it does, it only gets 150 mpg or some such, it will still be a testament to what is truly possible when you are willing to innovate and to let form follow function.

The designers at Accelerated Composites have moved the goal posts and pushed the edges of what we thought was possible and I hope that their design serves to inspire vehicle designers elsewhere to imagine what else might be possible, to truly innovate, and to begin designing the cars of tomorrow today.

Depending upon the completion of funding, a prototype could be ready to roll as early as the end of March or April, according to Steve Fambro.

[A hat tip to Green Car Congress]

Monday, January 23, 2006

'Precooling' Office Buildings Cuts Peak Energy Costs

PhysOrg reports that Purdue University engineers say they've developed a method for "precooling" small office buildings to cut energy costs.

PhysOrg reports that Purdue University engineers say they've developed a method for "precooling" small office buildings to cut energy costs.

According to James Braun, a Purdue professor of mechanical engineering, precooling would reduce energy consumption during times of peak demand, promising not only to save money but also to help prevent power failures during hot summer days.

Precooling involves running air conditioning at cooler-than-normal settings in the morning and then raising the thermostat to warmer-than-normal settings in the afternoon. The method has been shown to reduce the cooling-related demand for electricity in small office buildings by 30 percent during hours of peak power consumption in the summer, Braun said.

As PhysOrg points out, small office buildings represent the majority of commercial structures, so reducing the electricity demand for air conditioning in such buildings could help prevent rolling blackouts, such as those that plagued California during the summer of 2000.

Braun said the study focused on California because research was funded by the California Energy Commission, but the same demand-saving approach could be tailored to buildings in any state.

Reducing peak power demands is very important. Not only does it help prevent rolling black-outs which occur when peak demand exceeds generating capacity, but in the longer run, reducing peak demand avoids the construction of new power plants.

Power generating capacity must exceed peak power demands at all times, not just average demands. Peak demand can be two to three times higher than average demand (the exact amount varies regionally due to climate and local building/efficiency codes).

When peak demand exceeds generating capacity, power companies are forced to buy power from the 'spot market' - the open energy trading market; i.e. where Enron made all its money - often at prices significantly higher than the price they charge their customers. If peak demand exceeds capacity too often, utility companies are forced to build more power plants or contract for more output from other plants - i.e. increase capacity.

In short, additions to plant capacity are driven by increasing peak power demand, not increasing total consumption.

Technologies and practices like this that reduce peak demand are thus critical in maintaining the effectiveness and integrity of our power generation infrastructure while mitigating the need for new infrastructure investments. They are thus nearly always very cost effective, both for the business or home owner as well as for the utility company that gets to avoid the costs of adding new capacity or purchasing power at peak periods from the spot market.

[BTW, Interface Engineering of Portland used a simiar 'precooling' technique for their new Oregon Health Sciences University River Campus One building in Portland's new South Waterfront development district, which is expected to be (by far) the largets building to achieve LEED Platinum certification while cutting mechanical and electrical costs by 10%! Expect more on this soon...]

News From My Backyard: Oregon State University Energy Technology Takes the Waste Out of Wastewater

A new "microbial fuel cell" technology being developed at Oregon State University (OSU) could revolutionize the treatment of wastewater, according to a university press release.

A new "microbial fuel cell" technology being developed at Oregon State University (OSU) could revolutionize the treatment of wastewater, according to a university press release.

The system developed by my sister university just up the valley uses organic material that until now had been literally wasted - i.e. 'flushed' down the drain in our wastewater - and creates either usable electricity or hydrogen gas to potentially help fuel the cars of the future.

Some of the latest findings on these systems were recently published in a professional journal, Environmental Science and Technology, by engineers from OSU and Penn State University.

According to the press release, with only slight adaptations, these microbial fuel cell systems could take almost any biodegradeable organic matter and produce a useful product - such as the electricity to help operate a waste treatment plant or hydrogen for fuel cells, which many believe will be the most practical alternative to gasoline-powered vehicles.*

The press release goes on:When used with sewage, another fringe benefit of the process is that it also cleans the water by a completely different method than the traditional use of aerobic bacteria, opening the door for new generations of waste treatment plants that are efficient, effective and might produce much of the energy needed for their own operation.

"These systems would use oxidation to remove up to 80 percent of the pollutants in wastewater, and at the same time provide a substantial portion of the energy used to operate the treatment plants," said Hong Liu, an assistant professor of biological and ecological engineering in the OSU College of Engineering. "In the United States, about $25 billion a year is spent for domestic wastewater treatment, so major cost savings may be possible.

"And in developing nations where waste treatment technologies are often considered too expensive, making a waste treatment plant almost self-sufficient in energy might mean the difference between being able to afford proper treatment of wastes, compared to no treatment at all."

Those possibilities, Liu said, will take further refinement of existing technology. But the concept has clearly been proven in laboratory experiments, she said. It's renewable, and efforts are under way to bring down costs, identify less expensive materials and improve operational efficiency.

It's been known that microbial fuel cells can be run from high- energy materials such as glucose, but is now clear that many organic waste materials may also work, including grass straw, wood pulp, and of course wastewater. Bacteria oxidize the organic matters and, in the process, produce electrons that travel from the anode to the cathode within the fuel cell, creating an electrical current.

As a new concept in sewage treatment, this approach eliminates the need to pump oxygen into a mixture of sewage and aerobic bacteria - in one stroke eliminating almost half of the cost associated with a conventional sewage treatment plant.

For hydrogen production, some of the latest studies outline a related process in the absence of oxygen that uses an electrical assist to greatly increase the efficiency of direct hydrogen production at the cathode of the reactor. This "bio- electrochemically assisted microbial reactor" also treats the wastewater at the same time - just like in the approach used to create electricity - but instead yields hydrogen as a useful end product and the ultimate power source for hydrogen fuel cells. And the approach is more cost-effective than existing technology to produce hydrogen, which uses large amounts of electricity.

"Some of the newest experiments indicate that for hydrogen production, we can increase the amount of potential hydrogen recovered from sewage from about 15 percent to about 70 percent," Liu said. "This completely anaerobic technology is very promising, but we still have improvements to make."

Part of the challenge, scientists say, will be to identify less costly materials that produce results similar to those already being achieved in laboratories with fairly expensive materials, such as platinum.

Depending on the level of improved efficiencies and other improvements, researchers believe it may be possible to create sewage treatment plants that are completely self-sufficient in energy production. Alternatively, if there is more of a demand for hydrogen to use in fuel cells and the next generation of automobiles, the technology could be aimed in that direction. But in either case, what's now considered wastewater would become a valuable energy resource - not a waste.

In other work that's under way at OSU, oceanographers are using related processes to harness plankton in the ocean as a fuel source, creating mobile instruments that might glide through the water, producing their own energy as they go, and aid oceanographic research. And other devices might have value to provide energy in remote areas where organic materials are available but electrical grids are not.

The theoretical ability of microbes to produce electricity has been known for decades, scientists say, but only in the past few years has the efficiency of these devices been improved enough to make them useful for various purposes.

Some of the most recent research in this field has been funded by the U.S. Department of Energy and the National Science Foundation.

"Bacteria eat food to get energy, just like people do," Liu said. "But in the process they shed electrons, and this is something we're learning how to use. The concept is very environmentally safe and should find some important applications."

Well, it looks like this money is starting to pay off.

I'm always excited about technologies that utilize materials we previously thought were waste for some useful purpose, especially when that purpose is energy generation. There's not a lot of technical information in the press release and I wasn't able to find the journal article so I'm not sure what the efficiencies or yields of this process are but, for wastewater at least, they sound promising.

I'm not so sure these fuel cells would be the best use for all organic materials - there are plenty of other useful ways to utilize biomass including biofuels, co-firing, char to the solar-carbothermic zinc process etc - but these microbial fuel cells seem perfectly suited for wastewater treatment plants. If they can be scaled down enough, they could even be used 'on-site,' enabling individual buildings to treat their own wastewater before discharging it to the city wastewater system while generating electricity for building needs as well. Sounds like a win, win situation to me!

As far as getting the cost of materials down, it seems like this or this would help matters...

Keep up the good work up there, Beavers. Well done...

*[myself not necessarily included]

[A hat tip to Clean Edge]

Sunday, January 22, 2006

Half of Kuwait's Oil Reserves "Vanish" Overnight

Reuters reported on Friday* that Kuwait's oil reserves are actually half what was officially stated, according to internal Kuwaiti records reportedly seen by industry newsletter Petroleum Intelligence Weekly (PIW).

"PIW learns from sources that Kuwait's actual oil reserves, which are officially stated at around 99 billion barrels, or close to 10 percent of the global total, are a good deal lower, according to internal Kuwaiti records," the weekly PIW reported on Friday.

PIW reported that according to data circulated in Kuwait Oil Co (KOC), the upstream arm of state Kuwait Petroleum Corp, Kuwait's remaining proven and non-proven oil reserves are only about 48 billion barrels.

The Reuters article goes on:PIW said the official public Kuwaiti figures do not distinguish between proven, probable and possible reserves.

But it said the data it had seen show that of the current remaining 48 billion barrels of proven and non-proven reserves, only about 24 billion barrels are so far fully proven -- 15 billion in its biggest oilfield Burgan.

Kuwait has been adding up to 500 million barrels a year at Burgan which means the remaining non-proven reserves of some 5.3 billion barrels will likely be upgraded to proven, according to PIW.

Three consortia led by BP, Chevron and ExxonMobil are in the race for Project Kuwait, a 20-year operating service contract to raise crude capacity at four oilfields in the north of Kuwait.

So, just like that, world proven and unproven oil reserves drop by 5%. Many believe that Saudi Arabia and other OPEC nations have also been misleading (to put it gently) with their reserve figures as OPEC production quotas are based on the size of a nation's reserves.

If Kuwiat's reserves are only half of what they have been saying, and the same is more or less true for other OPEC nations, especially Saudi Arabia (who has the largest reserves in the world), then we are headed towards Peak Oil a lot faster than many have thought.

OPEC nations have traditionally been very secrative about their reserves and do not allow anyone outside the national oil company to verify records. How exactly PIW came across this information is not revealed but it presumably wasn't just given to them.

If the world is to accurately plan for Peak Oil, it has to know with some accuracy what kinds of reserves are truly out there and this continued obfuscation by Saudi Arabia, Kuwait and others is very counterproduction to everyone except those countries. I'm glad this news has leaked and I hope similar news will come out of other secretive oil producers as well.

By the way, this also comes only a couple months after news that Kuwait's largest oil field, Burgan field, has peaked and its production is beginning to decline.

*[i.e. 'dump day' or the day agencies release news they want to be buried since noone reads the papers on Saturday]

[A hat tip to Treehugger]

Saturday, January 21, 2006

6 E.P.A. Chiefs Say 'Its Time to Act' on Greenhouse Gases

The New York Times reports that six former heads of the United States Environmental Protection Agency, including five who served under Republican presidents, have strongly urged the Bush administration to act more aggressively to limit the emission of greenhouse gases linked to climate change.

Speaking on a panel last Wednesday that also included the current EPA chief, Stephen L. Johnson, they generally agreed that the need to address global warming was growing urgent and that the continuing debate over what percentage of the problem was caused by human activities was a waste of time.

The NY Times article goes on:"Why argue about things you can't prove?" said William D. Ruckelshaus, who served under President Richard M. Nixon from 1970 to 1973 and President Ronald Reagan from 1983 to 1985. "We need to fashion policies with proper incentives to reduce the amount of carbon we are putting in the atmosphere. There are all kinds of things we can do right now, and we ought to be taking those steps."

Mr. Johnson defended the agency's current policies, saying it has invested $20 billion since 2001 in research and technologies intended to cut carbon emissions through dozens of programs.

But the blunt opinions of Mr. Johnson's Republican predecessors served as a sharp reminder that since Mr. Bush took office in 2001, neither the president nor the Republican-led Congress has proposed any comprehensive plan to limit carbon emissions from vehicles, utilities and other sources, a problem that Mr. Bush's own Department of Energy predicts will grow worse.

The agency's Annual Energy Outlook for 2006, which was released last month, showed that carbon emissions from inside the United States are projected to increase by 37 percent by 2030.

While Mr. Bush has accepted the notion that the earth is warming, Congress has bogged down in debate over whether and how new air quality legislation should include a plan to deal with carbon emissions. The strongest measure approved so far was a Senate resolution passed last summer that recommended exploring how to put emission reductions in place.

But the former Republican administrators, along with one Democrat on the panel, Carol M. Browner, who served under President Bill Clinton, said administration officials and Congress had spent too much time debating.

"To sit back and push this away and deal with it sometime down the road is dishonest and self-destructive," said Russell E. Train, who led the agency under Nixon from 1973 to 1977.

William K. Reilly, the E.P.A. administrator under the first President Bush, attributed much of the inaction to an enduring skepticism from influential officials he called "outliers," who remain unconvinced that climate change is an urgent issue. As a leading skeptic in Congress, Senator James M. Inhofe, Republican of Oklahoma, convened a hearing last year with the novelist Michael Crichton, who argued that policy makers should take into account views held by scientists who believe global warming is part of a natural cycle.

Mr. Reilly said, "This is a debate we should not be having," arguing for action over debate.

Lee M. Thomas, the agency administration in the second Reagan administration, said the time had come for environmental and industry groups, the usual antagonists in environmental policy, to set aside their differences in favor of a plan like the one used to curb the effects of acid rain.

"This is the same kind of situation," Mr. Thomas said. "We've got to start on this action. We can't wait."

Ms. Browner, a strong proponent of a national policy to cut emissions, said she was encouraged to hear her Republican colleagues take aim at the administration.

"It's huge," she told reporters after the panel discussion. "It's a testament to the reality of the issue and the recognition that it's time to do something."

So my question is, how many people does it take saying things like this to get the Federal Government on board? This adds six former heads of the US EPA to a list that includes the UN’s Intergovernmental Panel on Climate Change (IPCC), the American Academy of Sciences, the American Meteorological Society, the American Geophysical Union, the American Association for the Advancement of Science, as well as the National Sciences Academies of all the G8 nations as well as India, China and Brazil and of course the governments of over 150 signatories to the Kyoto Protocol!

The states are starting to act on their own in the absence of federal leadership - i.e. California and others' adoption of CO2 emission standards for vehicles and the Northeast's Regional Greenhouse Gas Initiative - but its high-time for the Feds to get with the picture!

But I guess Michael Crichton still isn't convinced so maybe we should hold off and keep debating ...

Friday, January 20, 2006

Where Do All Your Tax Dollars Go?

And who get's the bulk of it? I'll give you a hint ... it's not the Deparment of Eduction.

Triple Pundit brings our attention to a wonderful graphical chart that proportionally illustrates the breakdown of pretty much everything the US government spent money on in 2004.

The chart displays the United States discretionary budget - all the money Congress has control over, so basically all the money taken out of your paycheck for the Federal Income Taxes (Corporate and Excise taxes contribute a small portion as well) - in a series of circles varying in size proportional the the amount of tax revenue spent on them.

A small version of the graphic is below the fold:

Not surprisingly, over half of the tax revenue - some $399 billion of the total $782 billion 2004 discretionary budget - goes to the Department of Defense and various "defense" spending. The remaining half - $383 billion - is divied up amongst social services and public infrastructure expenditures headed by the Departments of Education, Health and Human Services, Veteran Affairs, Housing and Urban Development, Agriculture, Interior and of course Energy and Transportation as well as the Deparments of State and Homeland Security - there are others, but those are the big ones.

This breakdown of spending is much more informative than those typically issued by the government which also include mandatory spending on Social Security, Welfare and Medicare/Medicaid. These 'official' government spending breakdowns are misleading as the mandatory spending items skew the picture and hide what your Federal Income Taxes are really going towards - you pay seperate Social Security and Welfare checks so you know where those taxes are going.

Charts like this one (True Majority offers a similar but simplified animation that gets a similar point across) serve to truly illustrate just where your elected officials are spending your money. Remember, you voted for these guys. Did you really want them to spend over half your money making war machines for "defense" purposes? If not, I suggest you speek up - both at the polls next time around (assuming you have much of a choice between the two candidates) or through communication with your representatives and grass roots action.

If you ask me, this chart is a perfect illustration of a nation with its priorities in entirely the wrong place.

[BTW, U.S. defense funding is more than all our allies and most of our enemies combined. Check out True MajorityM for more...]

News From the Other Portland: Maine Enacts Pioneering e-Waste Recycling Law

So this isn't exactly energy news, but its good news nonetheless. Grist reports today that Maine became the first in the nation to require manufacturers to cover the cost of recycling televisions and computer monitors.

Similar to e-waste laws already in force in Japan and some European countries, the Pine State's new rule allows municipalities to bill the expenses of recycling dumped screens to manufacturers. The aim is to make it less costly for these localities to keep televisions and computer monitors -- which can contain about five pounds of lead each, as well as mercury, cadmium, and other toxic chemicals -- out of landfills.

Maine's groundbreaking-for-the-U.S. move is inspiring about 15 other states to consider similar legislation.

So bravo to our fellow progressives over there in that other Portland! You may talk a little funny but we love you anyway.

There's more at the Portland Press Herald.

U.S. Greenhouse Gas Emissions up 2% in 2004

Green Car Congress reports that the latest figures from the Energy Information Administration (EIA) show that total United States greenhous gas (GHG) emissions are up 2% in 2004, increasing to 7,122.1 million metric tons of carbon dioxide equivalent (MMTCO2e) from 2003’s 6,983.2 MMTCO2e.

Accoring to the EIA, the large growth in 2004 is the result of a surging U.S. economy, which in turn resulted in more energy use. GCC reports that the economy grew 4.4% in 2004 - the fastest since 1999 - and this in turn increased the carbon dioxide generated from energy use by 1.7%. However, greenhouse emissions grew slower than the economy which indicates that the U.S. greenhouse gas intensity - the amount of greenhouse gas emissions per unit of economic output - decreased by 2.1% in 2004.

Since 1990 (the benchmark year for the Kyoto Protocol), U.S. greenhouse gas emissions have increased by 15.8%, for an average annual increase of 1.1%, according to the EIA.

GCC reports that the 2004 increase in total greenhouse gas emissions is attributable primarily to a 1.7% increase in emissions of carbon dioxide to 5,973.0 million metric tons, along with increases in emissions of nitrous oxide (5.5%) and methane (0.9%). Emissions of engineered gases - hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and sulfur hexafluoride (SF6) - also increased, by 9.6 percent.

As in other countries seeing increasing GHG emissions, sometimes despite commitments to reduction targets [previous post], transportation is the biggest culprit here. Transportation emissions of CO2 climbed 3.1% from 2003 to 2004, and account for the largest percentage of carbon dioxide emissions (32.4%).

Almost all (98%) of transportation sector carbon dioxide emissions result from the consumption of petroleum products: motor gasoline, 1,162.6 MMT (60% of total); middle distillates (diesel fuel), 428.2 MMT(22%); jet fuel, 237.4 MMT(12%); and residual oil (heavy fuel oil, largely for maritime use), 54.6 MMT (2.8%).

The growth in transportation-related carbon dioxide emissions in 2004 included increases in emissions from the use of motor gasoline (21.2 MMT, up 1.9%), diesel fuel (17.9 MMT, up 5.1%), residual fuel oil (10.0 MMT, up 22.7%), and jet fuel (8.2 MMT, up 3.6%).

These figures indicate that if we truly want to reduce greenhouse gas emissions, we have to start doing one or both of the following:

(a) reduce the amount of transport fuel consumed, either through more efficient vehicles or through reducing vehicle miles traveled - i.e. simply driving less; or

(b) start using different transportaion fuels, fuels with reduced GHG emissions per vehicle mile traveled (VMT) - options include electric vehicles and plug-ins, cellulosic ethanol or FT fuels from biomass, zinc-air fuel cell vehicles and of course, hydrogen. The source of feedstocks for each of these fuels is crucial and effects the resulting GHG emissions per VMT. (Some, i.e. hydrogen from average U.S. electrical mix via electrolysis could even increase GHG/VMT).

Finally, while U.S. GHG intensity is decreasing, there is still much more we could do in terms of efficiency in the industrial, residential and commercial sectors as well as an accelerated transition towards clean, non-emitting, renewable sources of power including solar, wind, tidal, geothermal and low-impact hydro (and perhaps even nuclear although I'm still not sold there).

Thursday, January 19, 2006

Flow Batteries For Energy Storage

I've been meaning to write a post on flow batteries for some time now and it seems that James Fraser at the Energy Blog has beat me too it.

Flow batteries are a very promising emerging energy storage option that are fully scalable for both power and energy capacity up into the MW and MWh ranges and have load leveling/peak shaving, uninteruptable power supply and power quality management applications and are well suited for coupling with intermittent renewable energy sources.

Rather than be redundant, I'll simply exerpt the beginnings of his post here and refer you to the full post at the Energy Blog for more:"Flow batteries are emerging energy storage devices that can serve many purposes in energy delivery systems. They can respond within milliseconds and deliver power for hours. They operate much like a conventional battery, storing and releasing energy through a reversible electrochemical reaction with an almost limitless number of charging and discharging cycles. They differ from a conventional battery in two ways 1) the reaction occurs between two electrolytes, rather than between an electrolyte and an electrode and 2) they store the two electrolytes external to the battery and the electrolytes are circulated through the cell stack as required. The great advantage that this system provides is the almost unlimited electrical storage capacity (MWh), the limitation being only the capacity of the electrolyte storage reservoirs."

Head here for the full article.

[Thanks to James Fraser for an excellent post.

Flow battery graphic from www.axeonpower.com/flow.htm]

Wednesday, January 18, 2006

U.S. Foreign Policy Needs to Get Over Fears of Implausable 'Oil Weapon' Says New Study by Roger J. Stern

PhysOrg carried a story today on a new study by Roger J. Stern titled "Oil market power and United States national security," which appears in the Jan. 16-20 online Early Edition of Proceedings of the National Academy of Sciences.

Stern's article argues that the the decades-old belief that petroleum-rich Persian Gulf nations must be appeased to keep oil flowing is imaginary, and the threat of deployment of an "oil weapon" - i.e. an OPEC oil embargo - is in fact toothless. His review of economic and historical data also presents the controversial claim that untapped oil supplies are abundant, not scarce.

From PhysOrg:...

Stern's analysis, titled "Oil market power and United States national security," appears in the Jan. 16-20 online Early Edition of Proceedings of the National Academy of Sciences. In the article Stern argues that the longstanding U.S. security concern that our oil supply could be threatened is wrong.

The real security problem, says Stern, comes from market power. Persian Gulf oil producers, he says, collude to command artificially high prices that could never exist in a competitive market. Excessive OPEC profits result, he says. These contribute to instability in the region, terror funding and the likelihood that a Persian Gulf superpower could emerge if one state captured the oil production of its neighbors. Because of these threats, the United States has concluded it must use military force to block state-on-state aggression in the region and to contain terrorism.

"U.S. appeasement of the oil market power not only helps create these problems, it makes them inevitable," said Stern, a doctoral student in the Department of Geography and Environmental Engineering. "Why do we follow this schizophrenic policy? We do it because we believe the 'oil weapon' might be used to reduce our supply if we somehow offend the OPEC countries. My research shows the oil weapon is completely implausible." According to the journal article, recent history shows that attempts to use an oil weapon have consistently failed. The idea, Stern says, dates back to the mid-1930s, when the League of Nations considered cutting off oil to Italy as punishment for its aggression in Ethiopia. The league realized the oil weapon couldn't work, however, because non-league nations could continue to supply Italy. Keeping oil out of Italy would have required a blockade, an idea dismissed as impossible to enforce. What was true for Italy then is true for the United States today, Stern says.

By the 1950s, Stern says, the low price of Persian Gulf oil imports jeopardized the profits of smaller U.S. oil producers. To restore shrinking market share, the U.S. oil industry successfully lobbied Congress to limit imports, arguing that reliance on foreign oil would undermine national security. U.S. producers argued that low-priced, abundant imports were dangerous because they might someday be withheld. "The oil weapon of U.S. politics descends from this confection," Stern writes in his article.

In the early 1970s, fear of the oil weapon moved to center stage once again. An influential article in Foreign Affairs predicted fuel shortages and economic disaster if the United States did not honor Middle East oil producers' wish that Israel's borders be redrawn. The United States defied this wish, and in 1973 Persian Gulf states unleashed the oil weapon in response. They vowed to cut supplies to the United States if Israel did not return to its 1967 borders. But because the United States could obtain fuel from elsewhere, Stern argues, and because the Persian Gulf nations were dependent on oil revenue, their "attack" was quickly abandoned. Panic buying kept prices high for a while, but actual supply fell only a small amount. Still, fear of a fuel cut-off remained. "Diplomats misread the market," Stern writes. "The oil weapon is impotent, but belief in it is not."

Stern's hypothesis is that "threats do arise in the oil market, but not from the oil weapon but from the (OPEC) cartel's management of abundance." Stern said his research shows that since 1970 the cost of extracting oil in Saudi Arabia has dropped by more than one-half, a clear sign of abundance. He argues that Persian Gulf oil prices are being kept artificially high in order to generate monopoly profits for these nations.

"Because of oil's enormous returns, Gulf states try to seize control of each others' fields," Stern says. "Iraq invaded Iran and Kuwait for this purpose. Our military is there today trying to keep regional peace and prevent a new superpower. Yet this policy allows aggressive oil states like Iran to grow ever-richer and more dangerous from the product they sell to us."

U.S. leaders, Stern says, must stop allowing fear of the oil weapon to dictate foreign policy. Instead, he says, they must find ways to reduce our fuel demand. "It's like we're holding a gun to our own heads: Our belief in the oil weapon constrains our concept of what we can and cannot do in the Middle East and in our own economy," he says. "It also blinds us to the huge opportunity to make ourselves more secure by reducing our oil consumption."

John J. Boland, an expert on utility economics and environmental policy who serves as Stern's faculty advisor, said the journal paper, part of Stern's doctoral thesis, raises important issues. "It's a pretty significant article," he said. "One thing Roger does is attack the perception that petroleum is scarce. That's a very unpopular position, one that is aggressively disputed by our government, even though other analysts have also raised this idea."

Added Boland, who is a professor emeritus in the Department of Geography and Environmental Engineering at Johns Hopkins: "This paper presents an unpopular perspective that has profound implications for our nation's energy policy and foreign policy."

If Stern's historical analysis of past OPEC oil embargoes is correct and that panic buying, not real significant reductions in supply was the main result, then he may have something here. However, I would argue that the world is quite a different place now than in, say, 1967.

According to the Transportation Energy Databook (TDB), U.S. oil consumption has nearly doubled between 1965 and 2003 (the latest year of data in the TDB) from 11.51 million barrels per day (mm bbl/d) to 20.04 mm bbl/d. Furthermore, U.S. domestic oil production has fallen from 7.8 mm bbl/d in 1965 to only 5.74 mm bbl/d in 2003. As would befit such a situation, our share of imported oil has also rissen dramatically from 32.2% to 71.4%, more than doubling since 1965.

Additionally, the worldwide demand picture looks completely different now with developing countries like China and India becoming major oil consumers and expanding their consumption rapidly. The TDB reports the developing nations (i.e. now OEDC countries) now account for over 30 mm bbl/d of demand, up from onl 8.33 mm bbl/d in 1965. Such countires now account for 38.7% of worldwide demand making the worldwide oil market an entirely different place than in the 1960s.

My point in all of this is to say that the United States is facing increasing competition for foreign oil supplies while its consumption is rising and its domestic production is falling. It may not be as easy for the United States to secure alternate supplies of oil in the event that OPEC nations would unleash the 'oil weapon' and embargo sales to the U.S.

Stern's point that OPEC countries depend upon oil revenues and would be loath to cut-off their most glutenous consumer is obviously correct, but when there are other consumers out there now that are gulping up oil nearly as fast as the United States, they may be able to find a suitable replacement for their U.S. sales revenue - I'm sure China wouldn't mind taking over our oil contracts in the Middle East.

As for the claim that oil supplies are plentiful, not scarce, I would have to see his reasoning, but that seems hard to believe to me. The Peak Oil debate is hardly uncontroversial, but there seems to be substantial evidence that world oil demand is outsripping additions to supply and this situation shows no real signs of changing.

Ultimately though, I firmly agree with Stern's conclusions that we must reduce our oil consumption. It is clearly in the United States' interests - from an economic, national security and environmental standpoint - to reduce oil consumption. This can be accomplished in a number of ways from hydrogen to synthetic- of bio-fuels to efficient vehicles to a transition to electric vehicles and plug-in hybrids. Let's start this before we face the threat of another 'oil weapon' or another war in the Middle East to secure our interests there.

Monday, January 16, 2006

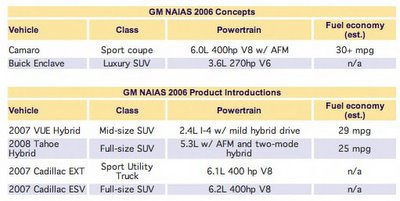

Automakers Show Their Green Side at the 2006 Detroit Auto Show - This Year it's Hybrids Galore

Green Car Congress and the Toronto Star both present excellent summaries of the 2006 North American International Auto Show held last week in Detroit. I will in turn provide a summary of the event here:

As is befitting for a major auto show coming on the heels of a year many have dubbed 'the year of the hybrid', the Detroit Auto Show saw automakers scrambling to show off their latest innovations in hybrid technology. Noticably absent where the slough of fuel cell concepts that were the stars of previous Detroit Auto Shows and the hybrid car - present in many shapes and sizes - took their place in the spotlight at this years show.

Automakers seem to be dealing with a schizophrenic market, polarized between demand for ever greater power and performance on one end and greener machines with an emphasis on fuel economy on the other. To this end, the Detroit show saw automakers unveil quite a few new beefy luxury sedans and new full-size and cross-over SUVs as well as a variety of new hybrid concepts and production models. As Bob Lutz, GM’s vice chairman of global product development, cracked during the show:"It’s two markets. The whole country is schizophrenic. At one end of the spectrum, you have people who want ecology. At the other end, they want power. I would call this diversity."

The major automakers seem to see the necessity of pleasing both ends of the market and are unveiling vehicles to fit both philosophies.

Here's a rundown of what the each major company brought to the table this year:

GENERAL MOTORS"General Motors is on a continuing quest to reinvent the automobile and to remove our vehicles from the environmental debate.

Central to this is GM’s three-prong advanced propulsion technology strategy... which is focused on reducing tailpipe emissions, ultimately to zero…while significantly improving fuel economy.

As part of this strategy in the near term we’re improving the efficiency of both our gas and diesel engines...introducing advanced six-speed transmissions...and aggressively pursuing alternative fuels.

These strides have already helped make GM an industry leader in fuel economy."

—Tom Stephens, VP GM Powertrain

General Motors used the Detroit show to formally introduced the Saturn Vue Green Line hybrid sport-utility which will go on sale this fall.  The Vue hybrid utilizes GM's Belt Alternator Starter (BAS) system and features an electric motor/generator mated to a 2.4-liter VVT four-cylinder engine and four-speed transmission powertrain that delivers an estimated 27 mpg city and 32 mpg highway (29 mpg combined)—a 20% improvement in combined fuel economy compared to the conventional VUE with a smaller and less powerful 2.2-liter engine.

The Vue hybrid utilizes GM's Belt Alternator Starter (BAS) system and features an electric motor/generator mated to a 2.4-liter VVT four-cylinder engine and four-speed transmission powertrain that delivers an estimated 27 mpg city and 32 mpg highway (29 mpg combined)—a 20% improvement in combined fuel economy compared to the conventional VUE with a smaller and less powerful 2.2-liter engine.

The Vue Green Line’s mild-hybrid system provides engine shut-off at idle, fuel cut-off during deceleration, electric motor/generator assist during acceleration and the capability to capture electrical energy through regenerative braking.

GM plans to offer the same system in the Chevrolet Malibu next year. GM also unvieled the new Chevy Tahoe hybrid. This two-mode hybrid is scheduled for introduction next year as a 2008 model. It's a full hybrid, incorporating two electric motors in the housing of a conventional transmission.

GM also unvieled the new Chevy Tahoe hybrid. This two-mode hybrid is scheduled for introduction next year as a 2008 model. It's a full hybrid, incorporating two electric motors in the housing of a conventional transmission.

A 25 per cent reduction in fuel consumption is claimed when the system is combined with a V8 engine using GM's Active Fuel Management system.

A GMC Yukon with two-mode hybrid technology also is coming. DaimlerChrysler, with whom GM is co-developing the system, plans to subsequently offer the system in their full-sized Dodge Durango.

Dieter Zetsche confirmed that Mercedes-Benz is working on a diesel-hybrid variation on the theme, and BMW, which has joined the co-development team, is expected to offer a version, according to the Toronto Star.

GM also showed off its new Camaro concept that delivers 400 hp with a 6.0L V8 while getting an estimated 30+ mpg.

Other GM offerings included a new Buick Enclave SUV concept as well as two new full-size Cadillac production models - the2007 EXT sports utility truck and the 2007 ESV SUV. [Graphic from Green Car Congress]

[Graphic from Green Car Congress]

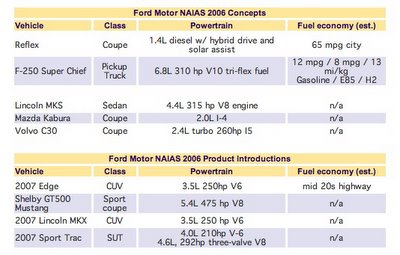

FORD MOTOR COMPANY"The innovation you see here today is just a sample of what’s going on throughout Ford Motor Company. We’re pushing Ford Motor Company to be the most innovation automotive company on the planet in design, in technological solutions to environmental challenges, and in safety."

—Bill Ford, Chairman and CEO, For Motor"Well, small is big these days...I think that same mode of thought is going to be relevant to the auto industry as well."

—J. Mays, Group Vice President of Global Design

Ford's lineup for the Detroit show included one of the most exciting and one of the biggest duds, in my opinion. On the top of my favorites list for the show is Ford's new diesel-electric hybrid muscle car concept, the Reflex hybrid. The innovative concept features a diesel-electric hybrid system using diesel, electric and solar power. This combination of power can deliver maximum fuel economy – up to 65 mpg in the city, says Ford – without compromising performance.

Reflex stores electric power from regenerative braking and two small roof-mounted solar panels in a new generation lithium-ion battery pack. The front wheels are powered by the diesel-electric hybrid system with the 1.4 liter turbodiesel engine assisted by an electric motor. The rear axle is also powered by an additional electric motor providing this low-slung muscle car with all-wheel-drive capability.

Stylish curves, gull-wing style doors and an interior which incorporates mesh seat covers for maximum airflow and comfort, LED instrument displays, advanced safety features and insulation material made out of ground rubber from scrap athletic shoes, called Nike Grind, rounds out the Reflex's features. As exciting as the Reflex is, Ford's other 'green' effort, the F250 Super Chief tri-fuel truck went off as a major dud in my book. The F-250 Super Chief uses the same Ford 6.8-liter V-10 Triton engine deployed in the company’s E450 H2ICE trucks modified in this case to run on either gasoline, E85 ethanol blend or hydrogen making it a true 'tri-fuel vehicle'.

As exciting as the Reflex is, Ford's other 'green' effort, the F250 Super Chief tri-fuel truck went off as a major dud in my book. The F-250 Super Chief uses the same Ford 6.8-liter V-10 Triton engine deployed in the company’s E450 H2ICE trucks modified in this case to run on either gasoline, E85 ethanol blend or hydrogen making it a true 'tri-fuel vehicle'.

Sounds pretty good, but when you look at the mileage this thing delivers, you'll see why I call it a dud. The Super Chief gets only 12 mpg when running on gasoline, a pathetic 8.6 mpg with E85 and 13.6 miles per kilogram on hydrogen. Numbers like that are more fitting for a bus or a delivery truck than a full-sized pickup. Nice try, Ford, but you've still got some work to do on this one...

MAZDA, which Ford owns a controlling interest in (about 34% I've been informed), came to the show with two interesting vehicles.

The first is a hydrogen ICE-electric hybrid concept version of its Mazda5 dubbed the Mazda5 RE Hybrid (the Mazda5 is known outside the U.S. as the Premacy). The concept combines Mazda's dual-fuel, hydrogen/gasoline rotary engine (RE) with an electric motor.

Mazda also showed its 2007 Tribute Hybrid, which shares its architecture and hybrid system with Ford's Escape.

Rounding out Ford's production line-up was the 2007 Edge/ and Lincoln MKX cross-over suvs, the 2007 Sport Trac sport utility truck and a new Shelby GT500 Mustang. Other concept cars featured at the show included the Lincoln MKS luxury sedan and a couple coupes - the Mazda Kaburo and the Volvo C30. [Graphic from Green Car Congress]

[Graphic from Green Car Congress]

CHRYSLER GROUP"The all-new 2007 Chrysler Aspen offers customers guilt-free indulgence. Loaded with premium features, stunning Chrysler design, fuel-saving MDS technology, standard safety features and best-in-class horsepower, torque and interior room, Chrysler Aspen offers more for less."

—Jeff Bell, Vice President, Chrysler

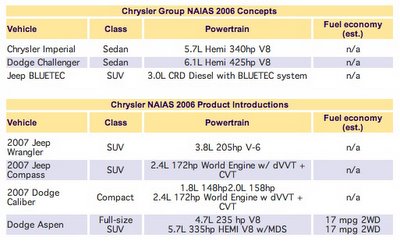

I'm not sure what exactly Jeff Bell means by 'guilt-free indulgence' in reference to the Aspen full-size SUV which gets only 17 mpg, but I do know that Chrysler was the only major automaker to show up at the Detroit show without a hybrid.

Chrysler seems to be banking on their clean high-efficiency diesel BLUETEC engines to carry their 'green' market segment demand. Chrysler plans for the BLUETEC to meet the most stringent emissions standards in the world and offer mileages competitive with hybrid vehicles.

Perfectly illustrating the current market polarization, Chrysler's Detroit concept line-up included a Jeep BLUETEC diesel concept SUV alongside two new beefy V8 sedans - the 340 hp Chrysler Imperial and the Dodge Challenger

Chrysler also showcased a new six-seater addition to their growing line of neighborhood electric vehicles (NEVs) offered through their wholly-owned Global Electric Motorcars (GEM) subsidiary. Their production models showed a similar split with the compact 2007 Dodge Caliber - which features a 1.8L or 2.4L version of Chrysler's WorldEngine with dynamic variable valve timing (dVVT) and a continuously variable transmission (CVT) - alongside several new Dodge and Jeep SUVs.

Their production models showed a similar split with the compact 2007 Dodge Caliber - which features a 1.8L or 2.4L version of Chrysler's WorldEngine with dynamic variable valve timing (dVVT) and a continuously variable transmission (CVT) - alongside several new Dodge and Jeep SUVs. [Graphic from Green Car Congress]

[Graphic from Green Car Congress]

TOYOTA"As you know, there are many reasons why consumers are interested in a hybrid, not least of which includes the constantly fluctuating cost of fuel. But it is clear today, that hybrid technology has moved solidly into the mainstream especially among consumers who are environmentally aware, and want to make a difference for future generations.

But there is even more to it than that. What we have found is that owning a hybrid makes owners feel good about themselves. It’s the sheer delight of owning the latest high-tech advancement. It’s the gratification felt with fewer stops at the gas pump…and the lower cost for a fill-up. For Prius owners who are now into their second or third hybrid, it is the astounding re-sale value of their vehicles have maintained, and their industry-leading level of both customer satisfaction…and reliability.

In a phrase, hybrids are quickly establishing themselves as a critical factor in Pride of Ownership."

—Don Esmond, SVP Automotive Operations, Toyota Motor Sales

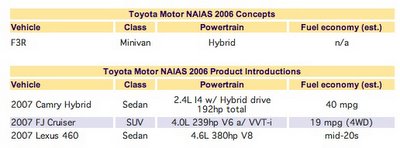

In a possible attempt to engineer a comeback for the minivan, Toyota brought their F3R minivan hybrid to the Detroit show.

Trying to break the 'minivans are for soccer moms' mold, Toyota's F3R features a fairly boxy exterior that reminds me of the Scion xB (also targeted for the youth market) and an interior featuring three rows of reconfigurable stadium seats and a wrap-around backrest that creates a continuous couch from the dash panel along the passenger’s side of the van and around the back that allow you to turn the inside of the vehicle into a kind of “lounge,” creating a more communal space for occupants to watch movies or play games on the F3R’s two track-mounted flat panel video screens. [Lot's more pictures including a few of the innovative interior at Autoblog]

The F3R also features Toyota's Hybrid Synergy Drive under the hood.

Featuring the newest version of the Hybrid Synergy drive, the Camry hybrid pairs a 105-kw electric motor with 199 lb-ft of torque with a lower-power (147 hp/110 kW), lower-torque (187 Nm) 2.4-liter Atkinson-cycle engine coupled to a continuously variable transmission. The result is a combined 192 hp (143 kW) from the hybrid system with 275 Nm of torque and an estimated fuel economy of 43 mpg US city, 37 mpg US highway (40 mpg US combined).

The hybrid Camry features a new ultra-small inverter and a specially designed compact 244.8-volt NiMH battery pack and transaxle.

Toyota expects to have the non-hybrid Camrys in showrooms in March, with the Camry Hybrid to follow several months later.

Not immune to the schizophrenic market, Toyota also showed up with their huge new 2007 FJ Cruiser which they hope will compete with the H3 as well as the 380 hp V8 Lexus 460 luxury sedan. Graphic from Green Car Congress]

Graphic from Green Car Congress]

HONDA"Honda has always led the way in reducing emissions, advancing fuel economy and developing alternative fuel technologies... we have considered it as our responsibility to produce the most environmentally responsible products and technologies possible ... even as we satisfy our customers.

Now ... to further advance environmental conservation, I think the entire auto industry must think of “we”—not just “me.” Each company must take responsibility and action by continuing to improve every product.

Toward this end, I want to challenge the entire industry, including Honda, to further improve fuel efficiency. So, let’s enter a race together. A race for the benefit of all customers and the global environment."

—Takeo Fukui, President and CEO, Honda Motor

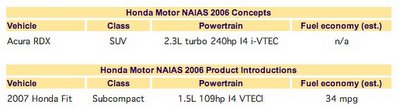

Honda didn't make a particularly impressive showing this year but also exhibited the market split in the two vehicles they did bring to the show. Honda showcased their Acura RDX concept SUV which features an innovative 2.3-liter four-cylinder turbocharged engine, Acura's exclusive Super Handling All-Wheel Drive, and is designed to combine sport utility with sports sedan handling and performance as Honda's entry into the premium SUV segment. This near-production prototype provides an advance preview of the all-new RDX that will go on sale this summer. On the other side of the market split, Honda also showed off its subcompact 2007 Honda Fit due to hit U.S markets this year. The US version of the Fit, already one of Honda’s hottest selling models in Asia and Europe (where it is sold as the Jazz), is fitted with a 4-cylinder 109 hp 1.5-liter VTEC engine coupled with a 5-speed transmission (available as an automatic or manual). Electronic Drive-by-Wire throttle control provides quick throttle response, smooth automatic transmission shifts (on automatic transmission models) and precise fuel delivery to the engine.

On the other side of the market split, Honda also showed off its subcompact 2007 Honda Fit due to hit U.S markets this year. The US version of the Fit, already one of Honda’s hottest selling models in Asia and Europe (where it is sold as the Jazz), is fitted with a 4-cylinder 109 hp 1.5-liter VTEC engine coupled with a 5-speed transmission (available as an automatic or manual). Electronic Drive-by-Wire throttle control provides quick throttle response, smooth automatic transmission shifts (on automatic transmission models) and precise fuel delivery to the engine.

The 5-door hatchback delivers estimated fuel economy of 33 mpg US city, 38 mpg US highway (33.8 mpg US combined). Emissions levels are rated as Low Emissions Vehicle 2 (LEV-2) by the California Air Resources Board (CARB) and Tier 2 / Bin 5 by the EPA. Like the U.S. version of the new 2007 Toyota Yaris, the U.S. Fit sadly will not be available with the smaller engines offered in European and Asian models.

Graphic from Green Car Congress]

Graphic from Green Car Congress]

OTHER AUTOMAKERS

Several other smaller automakers brought interesting new cars to the Detroit auto show as well.

BMW debuted a concept hybrid X3 cross-over SUV that is unique in its use of supercapacitors rather than batteries for energy storage.  The X3 concept is another performance hybrid SUV that combines a next-generation direct-injection inline six cylinder engine with an electric motor and supercapacitor energy storage that allows the SUV to accelerate from 0–60 mph in about 6.7 seconds. Fuel consumption compared to a conventional X3 is reduced by approximately 20% to an estimated 25 mpg US from the current 20 mpg US.

The X3 concept is another performance hybrid SUV that combines a next-generation direct-injection inline six cylinder engine with an electric motor and supercapacitor energy storage that allows the SUV to accelerate from 0–60 mph in about 6.7 seconds. Fuel consumption compared to a conventional X3 is reduced by approximately 20% to an estimated 25 mpg US from the current 20 mpg US.

Supercapacitors offer much higher power ratios than the nickel-metal hydride or lithium-ion batteries typically used in hybrids and do not store power chemically allowing them to absorb and discharge energy much faster than batteries. A supercapacitor offers specific power density of approximately 15 kW/kilogram, compared to about 1.3 kW/kg in the case of a nickel-metal hydride battery. The disadvantage of supercaps versus the battery is the far lower energy density—but given the burst-mode design of the BMW hybrid, supercaps fit the bill quite nicely.

SUBARU brought to exciting vehicles to the table this year.

The Subaru TPH powertrain in the B5-TPH concept sandwiches a thin, 10-kW motor generator between a newly-developed 2.0-liter Miller cycle engine and the automatic transmission. The Miller Cycle turbo Boxer engine in the B5-TPH operates up to 30% more efficiently than a conventional gasoline engine and delivers 256 hp, with 343 Nm of torque while achieveing an estimated 40 mpg (combined). Compare this to the Toyota Camry which offers only 192 hp and achieves the same gas mileage and you'll see how exciting this concept is - granted, the 2-seater touring car is likely smaller and lighter than the Camry sedan but the B5-TPH nevertheless delivers excellent performance while simultaneously achieveing excellent gas mileage.

Subaru’s parent company, Fuji Heavy Industries, has been developing the TPH powertrain for future mass production and plans to test-launch TPH-powered Subaru Legacys in the Japanese market next year [let's hope they come to the U.S. soon as well].

The second 'green machine' Subaru showcased at the Detroit show was a test version of its R1e urban electric vehicle equipped with next-generation long-life lithium-ion type batteries from NEC Lamilion Energy.

NISSAN used the Detroit show to unveil two new additions to its growing line of cars featuring continuously variable transmissions or CVT - the compact 2007 Sentra and the 2007 Versa sedan. [Nissan already offers their 2006 Murano cross-over SUV with their Xtronic CVT transmission].

The Sentra sedan features a 2.0L, 135hp four cylinder engine which when coupled with the CVT option now added to the choice of available transmission will deliver 32 mpg (combined) [a number of pics of the 2007 Sentra can be found here].

The Sentra sedan features a 2.0L, 135hp four cylinder engine which when coupled with the CVT option now added to the choice of available transmission will deliver 32 mpg (combined) [a number of pics of the 2007 Sentra can be found here].

The Versa is new to the Nissan product line and is positioned below the Sentra as its new entry level vehicle and will price it starting at around $12,000  and maxing out around $15,000 while Sentra is pushed up half a knotch and gets a bit more size and content while remaining under $20,000. The Versa is available as a sedan and a hatchback and features a 1.8L four cylinder engine delivering 120 hp. The Versa will be avialable in three transmissions: a standard 6-speed manual, an available 4-speed electronically controlled automatic with overdrive and a version of Nissan’s Xtronic CVT which will offer the best fuel economy at an estimated 38 mpg combined city/highway.

and maxing out around $15,000 while Sentra is pushed up half a knotch and gets a bit more size and content while remaining under $20,000. The Versa is available as a sedan and a hatchback and features a 1.8L four cylinder engine delivering 120 hp. The Versa will be avialable in three transmissions: a standard 6-speed manual, an available 4-speed electronically controlled automatic with overdrive and a version of Nissan’s Xtronic CVT which will offer the best fuel economy at an estimated 38 mpg combined city/highway.

Speaking on their expanded use of CVT at Detroit, Carlos Ghosn, President and CEO Nissan said: "Nissan remains the industry leader in CVTs, in experience, in units in operation, and in applications, with three separate CVT designs in production.

CVTs give customers smooth, responsive performance and a cost-effective way to improve fuel economy. For every one million CVTs in operation, we will deliver environmental benefits equal to 200,000 hybrids." Last but certainly not least, MITSUBISHI MOTORS brought perhaps the most exciting vehicle to the Detroit Auto Show, the Mitsubishi Concept CT series-parallel hybrid. The Concept-CT MIEV is a stylish five-door, four-passenger series-parallel hybrid that uses a compact gasoline generator and a bank of high energy-density lithium-ion batteries to power the in-wheel motors and drive each of its four wheels.

Last but certainly not least, MITSUBISHI MOTORS brought perhaps the most exciting vehicle to the Detroit Auto Show, the Mitsubishi Concept CT series-parallel hybrid. The Concept-CT MIEV is a stylish five-door, four-passenger series-parallel hybrid that uses a compact gasoline generator and a bank of high energy-density lithium-ion batteries to power the in-wheel motors and drive each of its four wheels.

The 1.0-litre, three-cylinder gasoline engine is located behind the rear-seat passengers and ahead of the rear-axle line, with 20 kW (26.8 hp) electric motors in each of the four wheels yielding a combined output of 134 hp [the four in-wheel motors provide a total of 80 kW or 107 hp indicating that the gasoline engine does indeed provide some additional tractive power - about 27 hp - as well as generate electricity to charge the batteries, making the Concept-CT a true series-parallel hybrid -although more on the series side of things than, say, Toyota's Synergy Drive].

The Mitsubishi In-wheel Electric Vehicle (MIEV) hybrid powertrain is currently being tested in Japan in a 4WD Lancer Evolution prototype and was previously tested in a prototype based on the front-wheel drive Colt. Mitsu's goal is to bring an MIEV model, built around the core technologies of in-wheel motors and high-density lithium-ion batteries, to market by 2010 (perhaps as early as 2008).

More exciting still are rumors (supported by a comment from Mitsu VP for Marketing, Wayne Killan, quoted in the Chicago Tribune) that Mistubishi is working on a plug-in hybrid MIEV. The Tribune quoted Killan as saying, "We would expect the car to be used in electric-only mode only in cities, where you could have access to a quick charge," seemingly referring to plug-in capabilities. He also mentioned that the vehicle could be recharged in a scant 10 minutes suggesting the use of a quick-charge battery like those being developed by Toshiba, A123, NEC and others and featured in Subaru's R1e electric vehicle (see above).

CONCLUSION

Well that rounds out the list. All in all, the 2006 Detroit Auto Show had quite a few exciting new vehicles to offer (amongst a few duds and a bit more of the same old new full-size SUV crud). One thing seems to be certain: the auto industry is evolving at a pretty quick pace right now.

It also seems clear that the immediate focus for 'green' vehicle development has shifted from fuel cells to hybrids. I hope that this does not uneccessarily delay continued research on hydrogen vehicles and other alternatives for the long run but I'm glad to see more work being done on hybrids - hopefully with the eventual goal of plug-in hybrids on the market in a couple years.

It's also good to see a bit of work on electrics as well - notably not from the major manufacturers but from the smaller Mitsubishi and Subaru.

The trend with both hybrids and electrics seems to be moving towards incorporating lithium-ion batteries into production models soon which is good move in my opinion. Greater battery life and energy and power density than nickel-metal hydride batteries makes lithium-ion batteries much better suited to vehicle applications.

Now if I can just get my hands on a Reflex to tool around town in...

Sunday, January 15, 2006

China Now World's Second Largest Auto Market

In another indicator of China's rapid economic growth, the People's Daily reports that China has now surpassed Japan to become the second largest automotive market in the world. According to statistics issued by the China Automotive Industry Association (CAIA), China's auto sales were close to 5.92 million units in 2005, surpassing Japan's sales of 5.8 million to rank second in the world behind the United States.